Chasing late payments and spending hours manually creating invoices can severely limit your business's growth potential. For creators and small business owners, time is your most valuable asset, and administrative tasks like invoicing are a significant drain. The right automated invoicing software solves this problem by streamlining how you bill clients, track payments, and manage your financial records, freeing you up to focus on your core work. Before exploring specific invoicing tools, understanding the wider context can be beneficial; consider this a practical guide to automating various business processes to see how invoicing fits into a larger strategy.

This resource is designed to help you navigate the crowded market of invoicing platforms. We have analysed twelve of the top solutions, from comprehensive accounting suites like QuickBooks and Xero to specialised tools perfect for freelancers and digital creators. For each option, you will find a detailed breakdown of its key features, pricing structures, and ideal use cases. We also provide screenshots and direct links to help you evaluate each platform's interface and user experience. Our goal is to provide a clear, practical comparison, enabling you to confidently select the software that best aligns with your specific business needs and budget, so you can get paid faster and more reliably.

1. MyMembers

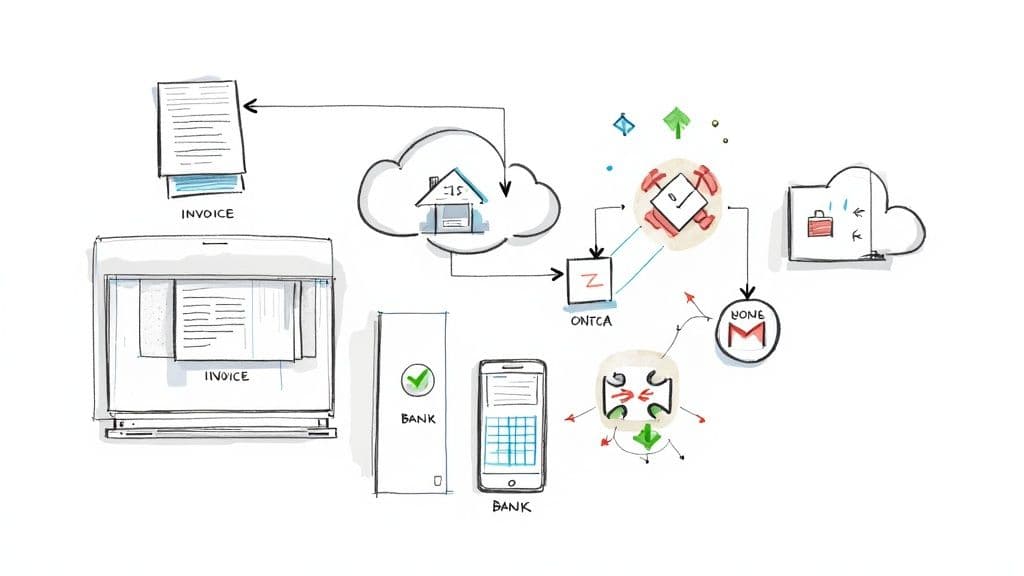

MyMembers presents a uniquely powerful solution for creators and entrepreneurs who monetise their communities exclusively on Telegram. While not a traditional invoicing tool, it excels as a highly specialised form of automated invoicing software by completely automating the subscription billing and payment collection cycle for Telegram channels and groups. Its standout feature is the seamless, no-code integration that allows for the launch of a paid community in under three minutes, a process that is expertly guided and remarkably straightforward.

847f652d-ca91-4836-9fff-222bc50ee860.jpg

This platform's core strength lies in its intelligent automation. The integrated Telegram bot handles all member management, automatically inviting new subscribers upon successful payment and revoking access when subscriptions expire. This eliminates the significant administrative burden of manually tracking payments and updating member lists, allowing creators to focus entirely on delivering valuable content.

Key Strengths & Use Cases

MyMembers is engineered for direct-to-community monetisation. For a fitness coach offering premium workout plans or a financial analyst sharing exclusive market insights, the platform transforms a Telegram channel into a predictable revenue stream. It automates the entire payment lifecycle, from presenting a custom-branded paywall to processing recurring subscription fees via Stripe.

The platform is particularly effective for running promotional campaigns. You can easily configure free trials or offer discounted initial periods to entice new members, all managed within the system. This functionality, combined with real-time analytics on revenue and subscriber growth, provides the data needed to refine your monetisation strategy effectively.

Our Take: For Telegram-centric businesses, MyMembers is an unparalleled tool for automating recurring revenue. It elegantly solves the specific challenge of monetising a Telegram community with zero technical overhead, making it a standout choice for creators who prioritise simplicity and efficiency.

- Pricing: A transparent 5% commission on transactions, with no monthly platform fees.

- Best For: Creators, educators, and businesses using Telegram as their primary platform for paid content or community access.

- Website: https://mymembers.io

2. QuickBooks UK

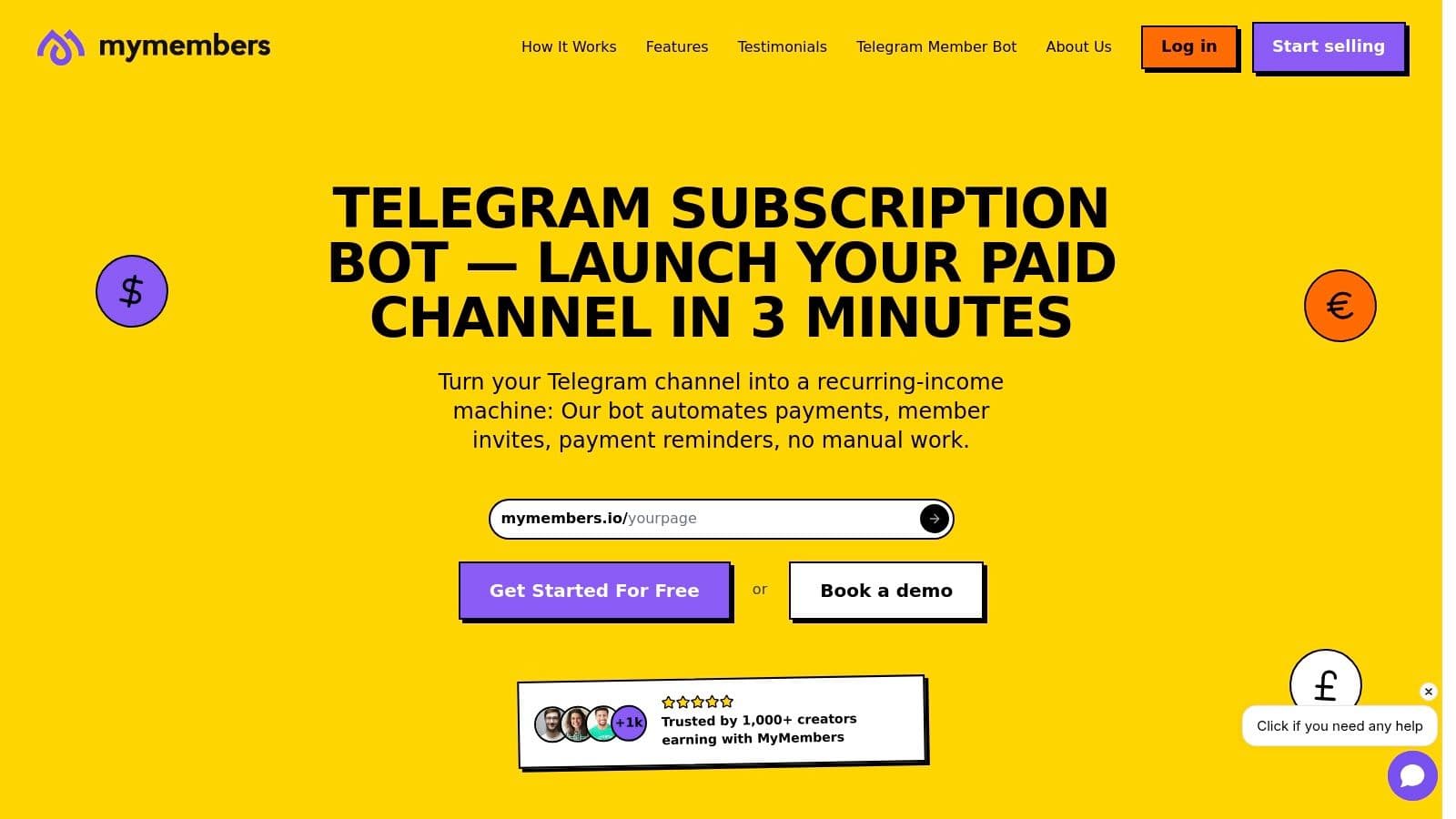

QuickBooks UK is a dominant force in the accounting world, offering a robust platform that extends far beyond simple invoicing. It’s an ideal solution for UK-based small businesses, freelancers, and creators who need a comprehensive financial management tool, not just an invoicing app. What sets it apart is its deep integration with the UK's financial and regulatory ecosystem, particularly its seamless compliance with HMRC's Making Tax Digital (MTD) for VAT.

b3e49f7b-3bbf-42c3-bbf0-9aed11c582d8.jpg

This automated invoicing software allows you to create professional, customisable invoices and set up recurring billing for subscription services or retainer clients. The platform automates payment reminders, helping to reduce late payments significantly. Its mobile app is particularly useful for creators and trainers who need to issue invoices immediately after a session or sale. While the user-friendly interface is a major plus, new users should anticipate a slight learning curve for its more advanced reporting and accounting features.

Key Features & Considerations

- Best For: Small to medium-sized UK businesses needing an all-in-one accounting and invoicing solution.

- Standout Feature: Direct MTD for VAT submissions to HMRC, making tax compliance straightforward.

- Pricing: Plans start from £14 per month for the 'Self-Employed' tier, scaling up to £32 per month for the 'Simple Start' plan and higher for more advanced needs.

- Pros: Excellent reporting, strong mobile app, and reliable customer support.

- Cons: Can become expensive for those only needing basic invoicing; advanced features require some acclimatisation.

Website: https://quickbooks.intuit.com/uk/

3. Xero UK

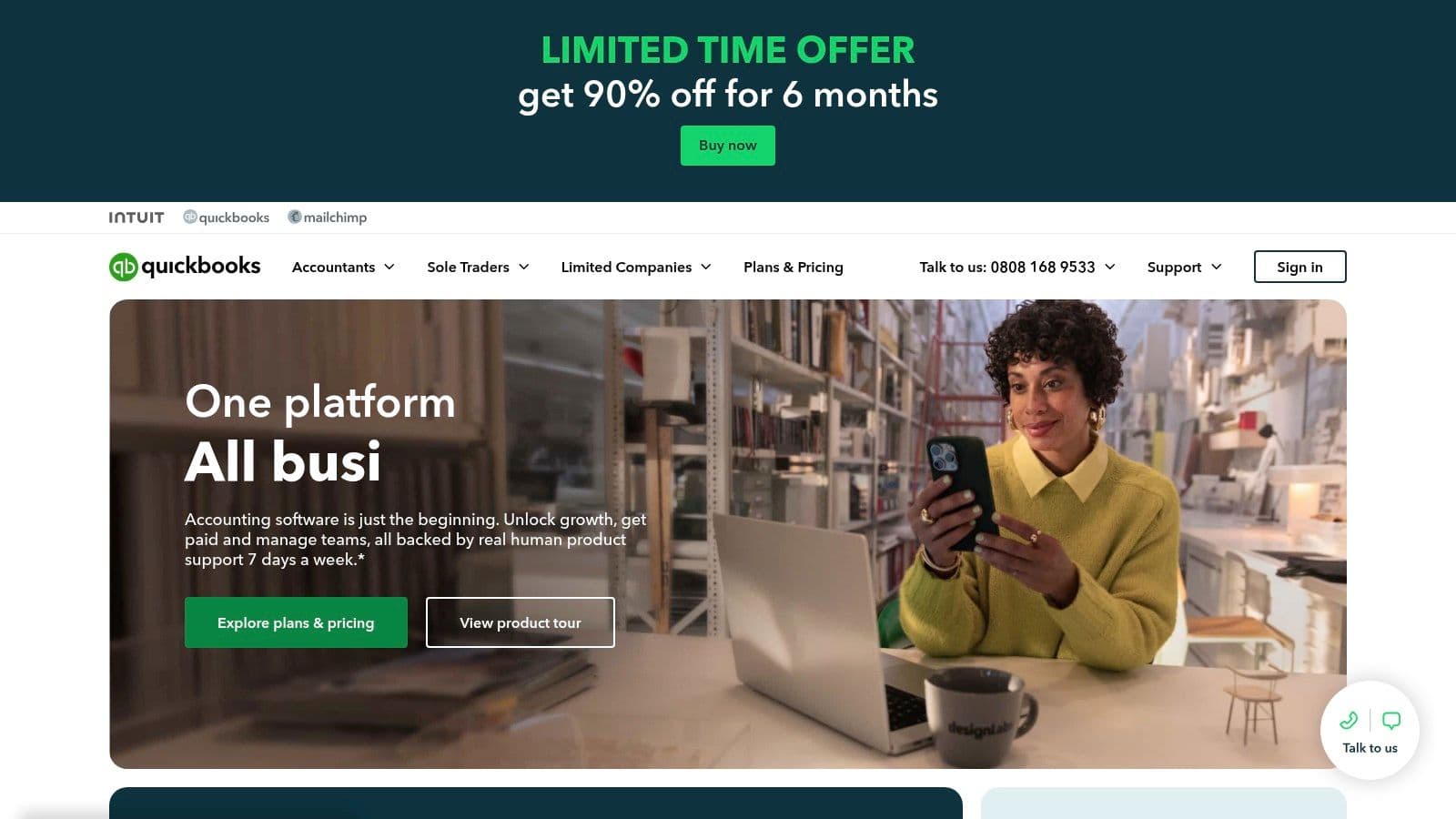

Xero UK is renowned for its beautiful, intuitive design, positioning itself as a strong competitor in the small business accounting space. It excels at simplifying complex financial tasks, making it a favourite among creative professionals, consultants, and online educators who value a clean user interface. The platform is fully compliant with HMRC's Making Tax Digital (MTD) for VAT, removing a significant administrative burden for UK businesses.

4c2ddfb1-3d79-40da-ad62-08f77409b078.jpg

This automated invoicing software empowers users to create and send customised invoices from anywhere using its robust mobile app. You can automate invoice reminders to gently nudge clients for payment and accept online payments directly, which helps improve cash flow. While Xero's feature set is comprehensive, new users should be aware that some essential functions, like expenses, are only included in higher-tier plans. Its strengths in integration and user experience make it a powerful tool for business process automation.

Key Features & Considerations

- Best For: Small businesses and sole traders who prioritise a user-friendly interface and strong integration capabilities.

- Standout Feature: An exceptionally intuitive user experience and a vast ecosystem of over 1,000 third-party app integrations.

- Pricing: Plans start from £15 per month for the 'Starter' plan (with invoice limits), scaling to £30 per month for the 'Standard' plan and higher.

- Pros: Beautifully designed interface, excellent mobile app, and extensive integration options.

- Cons: The entry-level plan has significant limitations; can become pricey for businesses needing full features.

Website: https://www.xero.com/uk/

4. Sage UK

Sage UK offers a powerful accounting and payroll suite that is a mainstay for small and medium-sized businesses across Britain. Its invoicing capabilities are deeply integrated into its wider financial management system, making it an excellent choice for creators and businesses looking to scale. The platform excels at providing a comprehensive overview of cash flow, from invoice creation to payment reconciliation, and is fully compliant with HMRC's Making Tax Digital (MTD) regulations.

d33bc409-9bbc-4ef8-ad80-783cbc096b22.jpg

This automated invoicing software enables you to send and track customisable invoices directly from the platform or its mobile app. You can automate late payment reminders to maintain healthy cash flow without manual intervention. While its feature set is extensive, new users, especially those without an accounting background, may find the interface more complex than simpler, invoice-only tools. However, for a growing business that anticipates needing robust accounting features down the line, starting with Sage can prevent a difficult future migration.

Key Features & Considerations

- Best For: Growing UK-based businesses and service providers needing a scalable, all-in-one accounting solution.

- Standout Feature: Deep integration with UK bank feeds and comprehensive MTD for VAT support.

- Pricing: Plans begin at £14 per month for the 'Start' tier, with the 'Standard' plan at £28 per month offering more advanced invoicing features.

- Pros: Highly scalable for growing businesses, strong customer support, and comprehensive accounting features.

- Cons: Can be more complex for beginners; higher cost compared to some specialised invoicing tools.

Website: https://www.sage.com/en-gb/

5. Zoho Books

Zoho Books is a powerful component of the wider Zoho ecosystem, offering an online accounting platform that excels in invoicing for small businesses and freelancers. It’s particularly attractive for those who need a scalable solution that can grow with their business. The platform enables users to create highly customisable invoices, automate payment reminders to chase late payments, and accept online payments through various gateways. Its strong multi-currency support makes it a great choice for creators and coaches with an international client base.

cbb2f741-c7ba-482c-9534-25df104ceff6.jpg

This automated invoicing software is also fully MTD-compliant, ensuring seamless VAT submissions directly to HMRC. What makes Zoho Books stand out is its balance of affordability and comprehensive features, all presented within a clean, user-friendly interface. While its free plan is a great starting point, businesses needing features like recurring invoices or payment reminders will need to opt for one of the very reasonably priced paid tiers. The mobile app is also robust, allowing for invoicing on the go.

Key Features & Considerations

- Best For: Freelancers and small businesses looking for an affordable, scalable accounting solution with strong integration options.

- Standout Feature: Excellent value for money and seamless integration with the extensive Zoho suite of business apps.

- Pricing: Offers a free plan for businesses with turnover under £35k. Paid plans start from £12 per organisation, per month.

- Pros: Affordable pricing, user-friendly interface, and fantastic integration capabilities within its own ecosystem.

- Cons: The free plan is quite limited; features like automated reminders are restricted to paid tiers.

Website: https://www.zoho.com/uk/books/

6. FreshBooks

FreshBooks has carved out a niche by focusing intently on service-based small businesses, freelancers, and creators, delivering an exceptionally user-friendly experience. It excels at simplifying the entire invoicing process, from creation to payment. What makes it stand out is its combination of robust invoicing with integrated time tracking and project management, making it perfect for those who bill by the hour or by project, like digital coaches or course creators. Its UK version is also fully compliant with HMRC's Making Tax Digital (MTD) for VAT.

1ae74c2e-d946-45f2-9eca-68b8a4a6d771.jpg

This automated invoicing software allows for the creation of polished, customisable invoices and automates payment reminders to chase late payments effectively. Its strength lies in how it seamlessly converts tracked hours and expenses directly into an invoice, saving significant administrative time. While celebrated for its intuitive interface and outstanding customer support, users should note that the entry-level plan is quite limited. To access its more powerful features, including recurring billing options ideal for retainers, you'll need to subscribe to a higher-tier plan. You can learn more about its recurring billing capabilities here.

Key Features & Considerations

- Best For: Freelancers and service-based small businesses who need integrated time tracking with their invoicing.

- Standout Feature: Seamless conversion of tracked time and expenses into client invoices.

- Pricing: Plans start from £11 per month for the 'Lite' plan, scaling to £22 per month for the 'Plus' plan, which includes more automation.

- Pros: Highly user-friendly interface, strong customer support, and comprehensive reporting tools.

- Cons: The basic plan has limited features; it can become expensive for sole traders with very simple needs.

Website: https://www.freshbooks.com/en-gb/

7. FreeAgent

FreeAgent is an award-winning online accounting platform specifically built for UK-based freelancers, contractors, and small businesses. Its strength lies in its simplicity and user-friendly design, making complex accounting tasks feel accessible. The software excels at demystifying business finances, from invoicing and expense tracking to managing tax obligations, including direct MTD for VAT submissions to HMRC.

18272f23-6165-46ef-8185-0d8d9c76f9b3.jpg

As an automated invoicing software, FreeAgent enables you to create and send professional, customisable invoices in minutes. You can set up recurring invoices for retainer clients or subscribers and automate late payment reminders to improve cash flow. Its integrated time tracking is particularly useful for creators and consultants who bill by the hour, allowing time entries to be added directly to invoices. While lauded for its ease of use, businesses with highly complex inventory or project management needs might find its feature set slightly limited compared to more expansive ERP systems.

Key Features & Considerations

- Best For: UK freelancers, contractors, and small business owners who prioritise a simple, all-in-one accounting solution.

- Standout Feature: An exceptionally intuitive user interface and outstanding UK-based customer support.

- Pricing: A single, all-inclusive plan at £29 + VAT per month, with frequent offers of 50% off for the first six months. Free for NatWest, Royal Bank of Scotland, or Mettle business account holders.

- Pros: Superb user experience, excellent reporting tools, and direct HMRC tax filing.

- Cons: May be too expensive for those with very minimal invoicing needs; lacks some of the advanced features of larger platforms.

Website: https://www.freeagent.com/

8. KashFlow

KashFlow is an online accounting software designed with UK small business owners in mind, offering a straightforward approach to financial management. It’s particularly suited for those who find more complex platforms like QuickBooks or Xero intimidating. The software simplifies bookkeeping and invoicing, making it accessible even for those without an accounting background. Its strong focus on usability means creators and small business owners can quickly get up and running, creating professional invoices and managing their finances with minimal fuss.

60706956-22f7-4911-962c-54a4c174cdde.jpg

This automated invoicing software provides customisable templates and allows for the setup of automated payment reminders to chase overdue payments effectively. A key benefit is its direct integration with online payment gateways, enabling clients to pay invoices instantly. While it is MTD-compliant for VAT, its real strength lies in its simplicity and award-winning UK-based support. The mobile app is handy for invoicing on the go, though some users may find the entry-level plan a bit restrictive as their business grows.

Key Features & Considerations

- Best For: UK-based sole traders and small businesses looking for an easy-to-use, no-jargon accounting and invoicing tool.

- Standout Feature: A highly intuitive user interface combined with excellent, accessible UK customer support.

- Pricing: Plans typically start from around £9 per month + VAT, with tiers for growing businesses and payroll features.

- Pros: Exceptionally user-friendly, comprehensive reporting tools, and strong customer support.

- Cons: The basic plan has limited features; it can become comparatively expensive for very small operations.

Website: https://www.kashflow.com/

9. Wave

Wave stands out in the crowded financial software market with a compelling offer: completely free invoicing and accounting. This makes it an incredibly attractive option for freelancers, sole traders, and small business owners just starting out, who need professional tools without the monthly subscription fees. It covers all the essentials, allowing users to create and send customised invoices, track expenses, and manage their accounts in one place. Wave is particularly effective for service-based creators who need a simple yet powerful system to manage their finances.

fb446bb3-a00f-46ff-9e22-d21aabe21c4d.jpg

This automated invoicing software enables you to set up recurring invoices for regular clients, which is a key component for managing a stable income stream. You can also automate payment reminders to gently nudge clients, improving your cash flow without manual effort. While the core software is free, Wave charges transaction fees for online payments, a common model for such platforms. Its MTD compliance also makes it a viable choice for UK businesses needing to submit VAT returns to HMRC, adding significant value for a no-cost tool.

Key Features & Considerations

- Best For: Freelancers, sole traders, and micro-businesses seeking a robust, free accounting and invoicing solution.

- Standout Feature: Completely free accounting, invoicing, and receipt scanning, with no monthly fees or limits.

- Pricing: Software is free. Transaction fees apply for online payments (e.g., card processing).

- Pros: No subscription cost, surprisingly comprehensive features for a free tool, and an intuitive user interface.

- Cons: Customer support is limited compared to paid services; not ideal for larger, scaling businesses needing advanced inventory or payroll features.

Website: https://www.waveapps.com/

10. Invoice2go

Invoice2go is a streamlined and highly accessible tool built specifically for the needs of small businesses, sole traders, and freelancers on the move. Its strength lies in its mobile-first design, making it exceptionally easy for professionals like fitness trainers or on-site consultants to create and send professional invoices immediately after a job is completed. It strips away the complexity of full-suite accounting platforms, focusing purely on getting you paid faster.

This automated invoicing software allows users to select from a gallery of customisable templates to ensure their brand looks polished and professional. The platform automates payment reminders to gently nudge clients, while also enabling the acceptance of online payments directly through the invoice. A key benefit is its expense tracking capability, allowing you to capture receipts on your phone and link costs directly to projects. While it offers powerful tools, the most impactful features are reserved for its higher-tier plans.

Key Features & Considerations

- Best For: Mobile-first freelancers, contractors, and small business owners who prioritise speed and ease of use.

- Standout Feature: An intuitive mobile app that allows for on-the-spot invoicing, expense tracking, and business reporting.

- Pricing: Plans start from a 'Lite' tier, with more comprehensive 'Standard' and 'Advanced' plans available that unlock more features and invoice allowances.

- Pros: Excellent user-friendly interface, strong customer support, and comprehensive reporting tools.

- Cons: The basic plan is quite limited; it can become expensive for sole traders with very simple needs.

Website: https://invoice.2go.com/

11. Zervant

Zervant is a user-friendly invoicing software designed specifically with European small businesses, freelancers, and sole traders in mind. It strikes a balance between simplicity and functionality, offering a clean interface that makes creating and sending professional invoices remarkably quick. The platform is particularly strong for those who need to manage finances across different European countries, supporting various currencies and tax regulations, including MTD for VAT submissions in the UK.

46e491e2-297b-45dc-b365-7e3cdd46d2af.jpg

This automated invoicing software enables users to build invoices from customisable templates, track expenses, and accept online payments to improve cash flow. A key feature is its time tracking capability, which is ideal for consultants, trainers, and creators who bill by the hour. While its free plan is a great starting point for very small operations, businesses will need to upgrade to a paid plan to unlock essential features like automated payment reminders and comprehensive reporting tools.

Key Features & Considerations

- Best For: Freelancers and small businesses in the UK and Europe who need a straightforward, multi-currency invoicing solution.

- Standout Feature: Integrated time tracking that converts billable hours directly into invoices.

- Pricing: Offers a free plan with limited features. Paid plans (Pro, Growth, Premium) start from approximately £7 per month.

- Pros: Excellent, easy-to-navigate user interface, strong mobile app, and helpful customer support.

- Cons: The free plan is quite restricted; can become costly for those needing advanced features.

Website: https://www.zervant.com/

12. Invoicely

Invoicely is a straightforward and accessible invoicing platform tailored for freelancers and small businesses who prioritise simplicity and efficiency. Its core strength lies in its clean, user-friendly interface that allows creators to generate professional-looking invoices in minutes. For consultants or trainers who need to bill clients quickly, the ability to create, customise, and send invoices from any device is a significant advantage. It covers all the essential bases without overwhelming users with complex accounting jargon.

6cc42baa-3d62-4b7d-9964-1c08d637d1fa.jpg

This automated invoicing software helps streamline cash flow by sending automatic payment reminders and accepting online payments directly through the invoice. Beyond invoicing, it offers basic expense, time, and mileage tracking, making it a well-rounded tool for sole traders managing their finances. While its free plan is a great entry point, businesses needing more advanced features like multiple payment gateways or MTD VAT compliance will need to upgrade to a paid subscription to unlock its full potential.

Key Features & Considerations

- Best For: Freelancers and small businesses looking for a simple, dedicated invoicing and expense tracking tool.

- Standout Feature: A very generous free plan that allows for unlimited invoices for up to five clients.

- Pricing: A free plan is available. Paid plans with more features start from approximately £7.99 per month for the 'Basic' plan.

- Pros: Extremely user-friendly interface, strong customer support, and comprehensive reporting tools on paid tiers.

- Cons: The free plan is quite limited in features; can become expensive for those needing advanced capabilities.

Website: https://invoicely.com/

Automated Invoicing Software Comparison

| Product | Core Features / Highlights | User Experience & Quality | Value & Pricing | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

| 🏆 MyMembers | No-code setup, Stripe integration, automated membership bot ✨ | Easy onboarding ★★★★☆ | 5% commission only 💰 | Creators on Telegram 👥 | Telegram-focused, instant payments, full automation ✨ |

| QuickBooks UK | Invoicing, payment reminders, UK bank integration, VAT/MTD | User-friendly ★★★★☆ | Mid to high cost 💰💰 | SMBs in UK 👥 | Strong UK tax compliance & bank integrations |

| Xero UK | Custom invoices, reminders, online payments, multi-currency | Intuitive ★★★★☆ | Mid to high cost 💰💰 | Small businesses 👥 | Multi-currency + strong integrations |

| Sage UK | Invoice customization, payment reminders, MTD compliance | Comprehensive ★★★★ | Higher cost 💰💰💰 | SMBs & growing businesses 👥 | Scalable features, strong support |

| Zoho Books | Invoicing, reminders, online payments, multi-currency support | User-friendly ★★★★☆ | Affordable plans 💰 | Small businesses & freelancers 👥 | Budget-friendly, robust integrations |

| FreshBooks | Invoices, reminders, payments, time/project tracking | Easy to use ★★★★☆ | Mid to high cost 💰💰 | Freelancers & SMBs 👥 | Time tracking & project management |

| FreeAgent | Invoicing, automated reminders, payments, time tracking | User-friendly ★★★★☆ | Mid cost 💰💰 | UK freelancers & SMBs 👥 | Full MTD compliance + time tracking |

| KashFlow | Invoices, reminders, payments, bank integration | User-friendly ★★★★ | Mid cost 💰💰 | Small UK businesses 👥 | Bank reconciliation included |

| Wave | Free invoicing, reminders, payments, expense tracking | User-friendly ★★★★ | Free 🆓 | Freelancers & small business 👥 | Completely free, basic features |

| Invoice2go | Invoices, automated reminders, payments, expense tracking | User-friendly ★★★★ | Mid cost 💰💰 | Small businesses & freelancers 👥 | Easy expense reporting |

| Zervant | Invoices, reminders, payments, expense tracking | User-friendly ★★★★ | Free & paid tiers 💰 | Small businesses & freelancers 👥 | Free plan available |

| Invoicely | Invoices, automated reminders, payments, expense tracking | User-friendly ★★★★ | Free & paid tiers 💰 | Small businesses & freelancers 👥 | MTD compliant with mobile invoicing |

Final Thoughts

Navigating the landscape of automated invoicing software can feel overwhelming, but making an informed choice is a critical step in reclaiming your time and professionalising your financial operations. Throughout this guide, we've explored a diverse range of platforms, from comprehensive accounting suites like QuickBooks UK and Xero UK to more specialised, creator-focused tools. The central theme is clear: manual invoicing is a relic of the past, and automation is no longer a luxury but a necessity for sustainable growth.

The key takeaway is that the "best" software is entirely subjective and depends on your unique business model. A digital coach with a subscription-based community has vastly different needs from a freelance content creator managing project-based invoices. Your selection process should be a deliberate exercise in matching features to your specific pain points.

Making Your Decision: A Final Checklist

Before you commit to a subscription, take a moment to synthesise what you've learned. Re-evaluate your priorities by asking these crucial questions:

- Scalability: Will this tool grow with me? Consider its ability to handle more clients, different currencies, and potentially more complex services like subscription tiers. A platform like Zoho Books offers a wide ecosystem, while a simpler tool might require a migration later on.

- Integration is King: Does it connect seamlessly with the tools you already use? Think about your payment gateways (Stripe, PayPal), your CRM, your project management software, and especially, for UK businesses, its Making Tax Digital (MTD) compliance. Poor integration creates more manual work, defeating the purpose of automation.

- True Cost of Ownership: Look beyond the monthly fee. Factor in transaction fees, the cost of essential add-ons, and the time investment required for setup and learning. A "free" tool like Wave might have higher transaction fees that become costly at scale.

- The User Experience: How does the platform feel to use? A clunky, unintuitive interface can be a significant source of daily frustration. Always take advantage of free trials to run a few test invoices and explore the dashboard.

Implementing Your New System

Once you've made your choice, a successful implementation is paramount. Start by dedicating a few hours to setting up your branding, customising invoice templates, and inputting client details. Most importantly, configure your automated workflows from day one. Set up recurring invoice schedules and automatic payment reminders immediately. This initial time investment will pay dividends for months and years to come, solidifying your new, efficient process for managing revenue.

Ultimately, adopting the right automated invoicing software is an investment in your business's most valuable asset: your time. By automating the tedious financial admin, you unlock more capacity for creative work, client engagement, and strategic growth. The right platform doesn't just send invoices; it empowers you to build a more streamlined, professional, and profitable enterprise.

If you're a creator, coach, or community owner managing memberships on platforms like Telegram, the invoicing challenge is often tied directly to subscription management. MyMembers is specifically designed to solve this by automating payments, member access, and invoicing in one seamless system. See how it simplifies creator finances at MyMembers.