Why PayPal Automatic Payments Change Everything

3012b087-52f2-45e4-8783-856b6e699729.jpg

Picture this: you're running your own show, juggling clients, software subscriptions, and all the everyday chaos that comes with it. Then, BAM! You get hit with a late payment fee because your website hosting slipped your mind. We've all been there, and it's a pain. That's where the beauty of automatic payments with PayPal comes in. It's more than just convenience; it's about taking the reins of your finances and giving your brain a break.

I used to dread the monthly bill-paying ritual. Hours wasted, constant worry about deadlines… Since I switched to automatic payments through PayPal, that stress has completely vanished. Knowing my essential services are covered lets me focus on the important stuff, like actually growing my business. Honestly, that peace of mind is invaluable.

The Impact of Automated Payments

This isn't just anecdotal; the stats back it up. PayPal's massive popularity, particularly in the UK, speaks for itself. A whopping 69% of UK consumers were using PayPal for online payments as of early 2025! That puts the UK near the top globally for PayPal adoption, just behind Germany, showing a strong regional preference for their services. Discover more insights about PayPal adoption rates. This widespread use means most businesses you work with probably already accept automatic PayPal payments, making the transition even smoother.

Beyond Convenience: Real Benefits

Automatic payments come with a whole host of perks for businesses and consumers alike. For businesses, it means more predictable cash flow. No more chasing late payments, just consistent income you can actually count on. This predictability makes financial planning and growth so much easier. Plus, automation slashes administrative overhead, freeing up time and resources for more important tasks.

Consumers aren't just dodging late fees either. Setting up automatic payments with PayPal can actually help build better financial habits. Automating essential expenses makes it harder to overspend on impulse buys. It's a more structured way to handle your money, which can lead to greater financial stability and long-term peace of mind. It’s a win-win situation.

Preparing Your PayPal Foundation for Success

936c62a0-bd8a-4095-a42f-18241596bf38.jpg

Before you dive into the world of automated PayPal payments, let's make sure your account is primed and ready. It's like building a house – you need a solid foundation. Trust me, I've seen what happens when people skip these initial steps. My friend Marcus learned this the hard way. He nearly lost his discounted gym membership because his automatic payments kept bouncing due to an expired card on file. Don't be a Marcus!

Choosing the Right Payment Methods

First things first, figure out which payment methods best suit your recurring billing needs. For smaller subscriptions, linking your debit card directly might work just fine. But for larger, more mission-critical payments, a credit card often provides better purchase protection and can even give your credit score a little boost if you manage it responsibly. Thinking about how your payment methods fit into your overall marketing strategy is a smart move, too.

Think of it this way: your debit card is great for that daily coffee subscription, but your credit card is better suited for that crucial software subscription you need for your business.

Backup Funding Sources: Your Safety Net

Next up, setting up a backup funding source. Consider this your financial safety net. This ensures that even if your primary payment method has a hiccup, your automatic payments will still go through, saving you from service interruptions and pesky late fees. This becomes especially important for essential services like your web hosting or business software. I learned this lesson firsthand when my primary card expired, and my project management software got temporarily deactivated. Let's just say it wasn't a fun day.

Having that backup is like having a spare tire in your car. You hope you never need it, but you're incredibly thankful when you do.

Security and Notifications: Finding the Balance

Now, let's talk security and notifications. Two-factor authentication is your friend. Enable it. It adds an extra layer of security without making it a pain for legitimate transactions. Also, customize your notification preferences. You want to stay in the loop about your automatic payments without getting bombarded with emails. I personally prefer to only get notified for failed or declined payments. Keeps my inbox nice and tidy.

Finding the right balance with notifications is key. You want to be informed, not overwhelmed.

International Payments and Currency Considerations

Finally, if you deal with international payments or multiple currencies, it's important to understand how PayPal handles currency conversion fees. Knowing this upfront will prevent any unexpected surprises on your statement. As a quick example, in the UK alone, there are about 2 million active PayPal users, demonstrating its significant presence in online payments. Globally, PayPal processes roughly 45% of all online transactions, making it a popular choice for both buyers and sellers. Want to learn more about PayPal's global reach? Check this out.

By taking the time to set up these basics, you’ll be setting yourself up for smooth sailing with automatic PayPal payments. Consider this your pre-flight checklist before takeoff.

Creating Your First Automatic Payment Setup

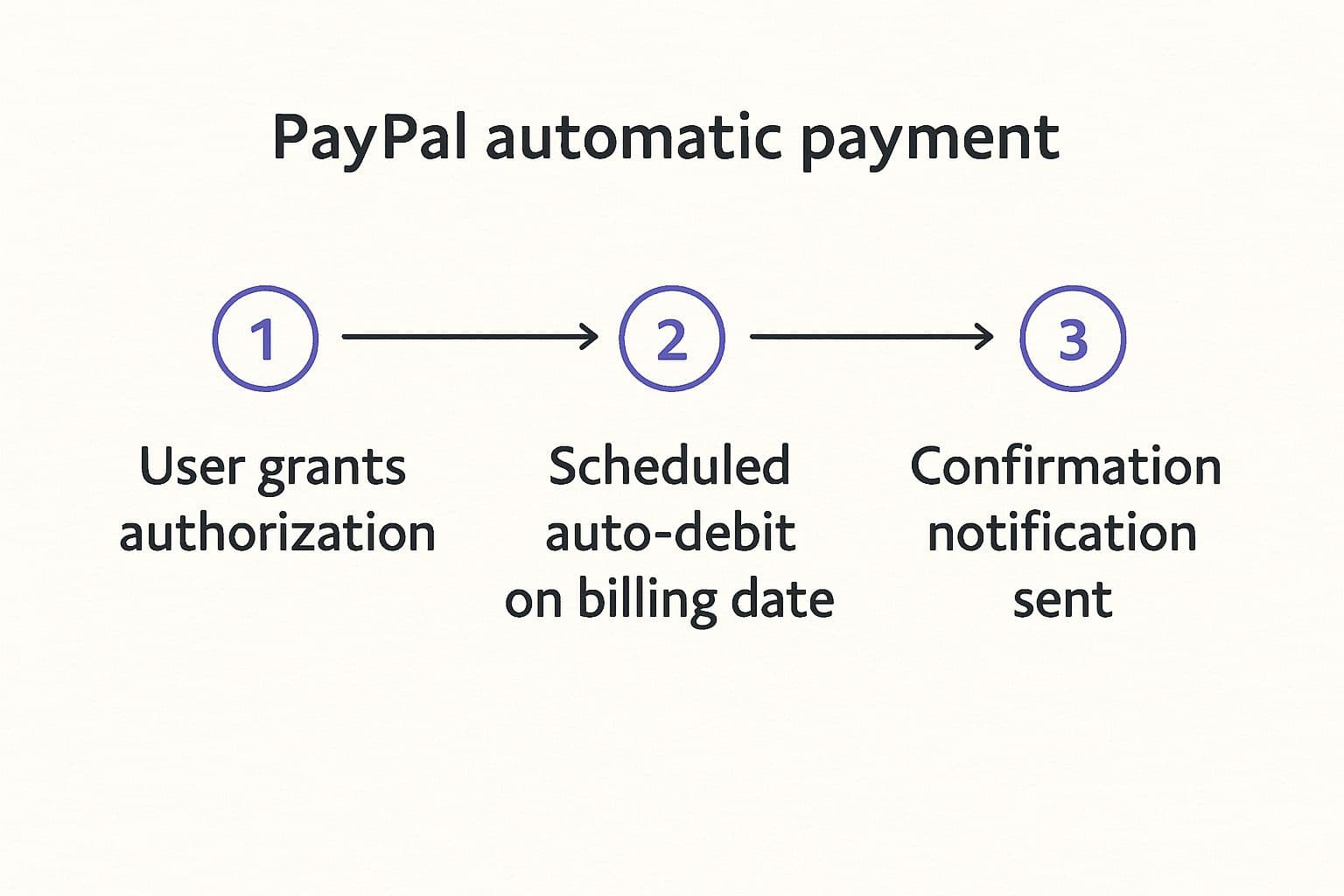

6c54e1dd-9d49-4488-859c-74185dbd8e53.jpg

This infographic shows how PayPal automatic payments work, from the user giving permission to the money being taken out and the confirmation. It's all designed to be simple and clear. From start to finish, PayPal makes automatic payments easy.

Now, let's dive into actually setting up your first automatic payment. There are a couple of ways this usually happens.

Merchant-Initiated Payments: The Easy Way

Think about signing up for your favorite streaming service. You probably see a button or checkbox at checkout that says "Subscribe with PayPal." That's a merchant-initiated payment. The merchant handles when and how much you pay in the future. Pretty straightforward.

PayPal-Initiated Payments: A Little More Control

Sometimes, especially with smaller businesses or independent creators, you might need to set up a PayPal-initiated payment. This means you do the setup inside your PayPal account. It gives you more control, but you have to do a bit more work upfront. I had to do this when I joined a coaching program on Telegram – I logged into PayPal and set up the recurring payment to the coach directly.

To give you a clearer picture of the different options, I've put together a comparison table:

PayPal Automatic Payment Methods Comparison

This table compares the different ways you can set up automatic payments with PayPal, showing what each one does, its limits, and what it's best for.

This table should help you decide which payment type suits your needs. Remember, understanding the differences can save you headaches later.

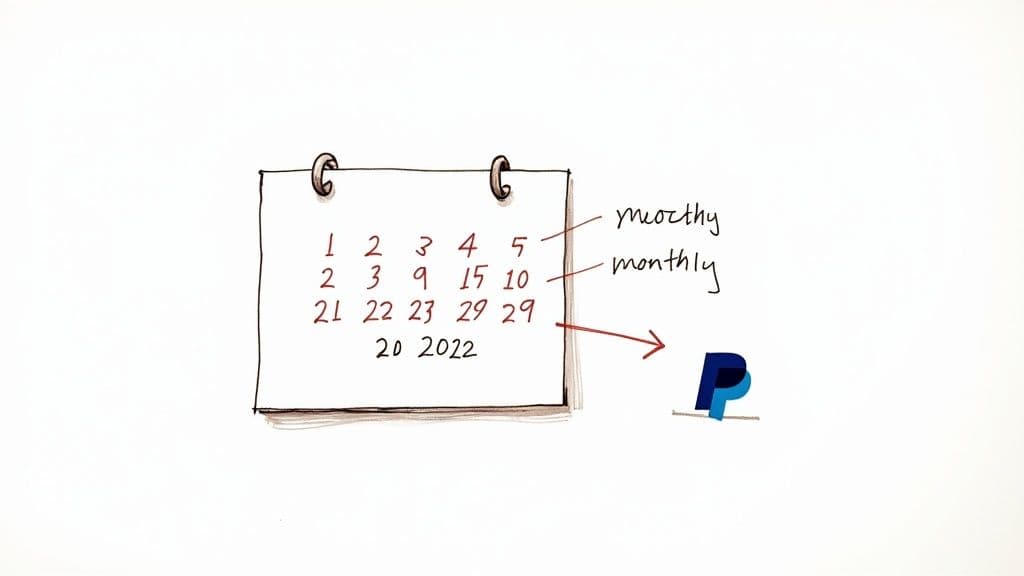

Configuring Payment Frequency and Limits

No matter who sets up the automatic payment, always check how often and how much you'll be paying. Is it monthly? Every three months? Make absolutely sure it works with your budget. You can usually set spending limits in your PayPal account, which is great for avoiding surprise charges if a subscription price goes up without you knowing.

My friend Emma, a freelance designer, schedules her software subscription payments to line up with her biggest client invoices. This helps her credit score because her balance is lower when her credit card statement is generated. Smart, right?

Testing and Troubleshooting

Once your automatic payments are set up, don't just assume all is well. Test it! Try a small, cheap subscription first, like a free trial for a music streaming service. This lets you see how the payments show up in your account and make sure you're getting the right notifications.

Sometimes, little things go wrong. Maybe a payment doesn't go through, or you get charged twice. Don't worry! PayPal's customer service is usually helpful. Keeping a clear record of your authorized payments makes fixing problems much easier. I use a spreadsheet to track my automatic payments – it’s saved me a lot of hassle. Even with automation, being organized is important.

Managing Multiple Payments Like a Financial Pro

9ff240b2-4001-4f2a-8c1f-c85df8f87417.jpg

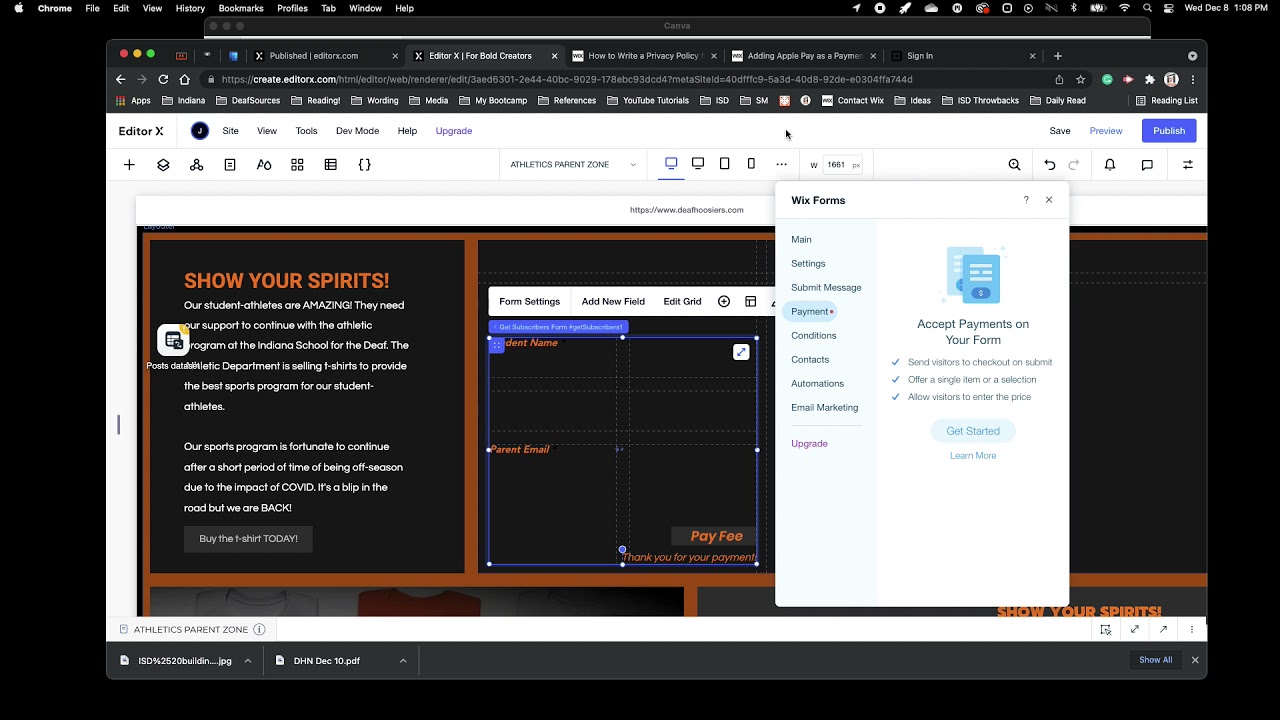

So, you're cruising along with PayPal automatic payments, right? Everything's automated, bills are paid on time – bliss. But then your subscriptions start to multiply. Different membership levels, varying billing cycles, a whole mix of amounts hitting your account. Suddenly, keeping track of everything feels like a second job. Don't worry, I've been there. Let me share some tips on how I wrangled my own payment chaos and achieved financial zen.

Building Your Payment Command Center

Your PayPal account is the obvious hub for recurring transactions, but honestly, just logging in and scrolling isn’t enough. I learned this the hard way. My personal solution? A trusty spreadsheet. Nothing fancy, just columns for the subscription name, amount, billing date, and any special notes. Having a single, clear view of all my outgoing payments is a game-changer. Some of my friends swear by budgeting apps that link directly with PayPal, like Mint. The key is finding a system that clicks for you and sticking with it.

It’s your financial command center. You're in charge.

Calendar Reminders and Early Warning Systems

Tracking is just the first step. The real magic is in the proactive stuff. I set calendar reminders a few days before any important subscription renewals. This gives me a chance to actually think about the service before the payment goes through. Do I still use it? Is there a better deal out there now? This simple habit has saved me a surprising amount of money over time.

Another lifesaver? Spending alerts within PayPal. Think of it as your financial early warning system. It’ll flag any unexpected price hikes or anything that just looks…off.

For example, I have an alert set for any transaction over £50. If something unexpected hits my account, I know about it instantly. Peace of mind is priceless, right? It's also worth remembering how closely linked automatic payments and mobile payments are these days, especially in the UK. PayPal and other services are a huge part of the contactless revolution. Did you know that contactless payments accounted for a massive 38% of all payments in the UK in 2023? Mobile is driving that surge. For more PayPal stats, check this out.

Maintaining Financial Clarity and Confidence

The best part of getting organized isn't just about the practical benefits. It's about the mental shift. Instead of that low-level anxiety about unexpected charges, you’re in control. You know what’s coming. This makes a huge difference when you’re making bigger financial decisions.

And if your financial situation changes – a new job, unexpected expenses – you can adapt quickly. Knowing where your money is going each month empowers you to adjust your spending and stay on top of your budget. This proactive approach is so much better than just letting automation run wild.

Plus, having a clear overview of your automatic payments makes updating your details a breeze. New card? Switched banks? You can easily update everything from your central tracking system. No more scrambling to update individual subscriptions or – worse – risking service interruptions. This organized approach transforms automatic payments from a potential headache into a powerful tool for financial well-being.

Solving Automatic Payment Problems Fast

embed

Let's be honest, automatic payments can be a lifesaver, but they're not always perfect. Things do go wrong. I'll never forget the 2 AM panic when my web host threatened to suspend my site because of a failed payment. No notification, nothing! So, let's dive into troubleshooting—because when automatic payments fail, you need solutions fast.

Common Payment Hiccups and How to Fix Them

The dreaded expired card is a classic. Suddenly, your subscriptions start bouncing like a bad check. First, take a deep breath. Log into your PayPal account, update your card details, and retry the failed payments manually. Pro tip: set calendar reminders for card expirations to avoid this entirely.

Another common issue is the mysterious duplicate charge. This happened to me with a software subscription. Turns out, I'd accidentally set up two recurring payments! The fix? Log into PayPal, find the duplicate, and cancel it. Always double-check your active subscriptions within PayPal especially after setting up something new. A little vigilance can save you a lot of hassle.

Disputed Charges and Cancelled Services

Ever cancelled a service only to see the payments keep coming? Infuriating, right? This happened to a friend with a gym membership. First, contact the merchant directly. If that doesn't resolve the issue, file a dispute through PayPal. Keep records of everything—cancellation confirmations, emails, everything. They'll be invaluable if things escalate.

Sometimes, PayPal itself might limit your account for security reasons or verification issues. This can freeze your automatic payments, causing major disruptions. If this happens, contact PayPal support immediately. Be polite, explain your situation clearly, and provide any documentation they need. Having a clear record of your PayPal automatic payments will make this process smoother. While you are managing all this you could always consider website management services.

Documentation: Your Secret Weapon

My top tip for solving payment problems quickly? Document everything. Seriously. Keep a spreadsheet or use a budgeting app like Mint or YNAB to track your automatic payments. Include subscription details, amounts, dates, and any communication with merchants or PayPal. Trust me, this organized approach will save you hours of frustration when (not if) things go sideways. It’s like having your own financial detective on call.

Think of it as building a case file for your financial well-being. The more evidence you have, the easier it is to solve the mystery of the missing payment or that phantom double charge. This not only saves you time but also reduces the stress of managing your finances. Knowing you have a system in place gives you the confidence to address problems efficiently.

Before we wrap up, I've put together a handy table summarizing some of the most common PayPal automatic payment issues and how to tackle them:

Common PayPal Automatic Payment Problems and Solutions

This table provides a quick reference for common issues. Keep it handy and refer back to it whenever you run into trouble. Remember, staying organized and proactive is key to managing your automatic payments effectively.

Advanced Strategies for Payment Automation Masters

Ready to level up your PayPal game and become a true automation pro? This isn't about setting it and forgetting it. It's about squeezing every drop of potential out of PayPal's tools to give yourself a real financial edge.

Mastering PayPal's Reporting Features

I'll be honest, for a long time, I barely glanced at PayPal's reporting features. I just checked my transaction history and moved on. Big mistake. Turns out, these reports are packed with insights. Seriously, they can tell you so much about where your money's actually going. I finally started digging into the monthly spending report and was shocked. Turns out, I was hemorrhaging money on software subscriptions I barely used! It was a wake-up call that helped me seriously rethink my budget.

And it's not just about finding hidden savings. These reports are a lifesaver come tax season. Tracking business expenses or charitable donations through PayPal becomes ridiculously easy. Think of it as preemptive tax-season stress relief. A little effort now saves you a major headache later.

Strategic Payment Timing for Optimal Cash Flow

Think about it: when you schedule your automatic payments can actually have a huge impact on your cash flow. If you can, try aligning your larger payments with times when you know you'll have more money coming in. This helps avoid those "uh oh, where'd my money go?" moments. I’ve even heard of freelancers who time their payments to line up perfectly with client invoices. Smart, right? Keeps their cash flow humming.

This kind of strategic thinking elevates automatic payments from a simple convenience to a powerful financial tool. It’s about being proactive and using your knowledge of your income and expenses to your advantage.

Integrating PayPal with Personal Finance Tools

You know those personal finance apps like Mint or YNAB? Many of them integrate directly with PayPal. This gives you a complete, birds-eye view of your finances in one place. No more jumping between platforms. Everything's centralized.

Imagine all your transactions, automated and manual, flowing effortlessly into your budgeting app. Bye-bye manual data entry! Hello, clear, real-time snapshot of your financial health. This type of integration is especially handy if you’re juggling multiple accounts and payment methods, which, let’s be honest, most of us are.

Advanced Tips and Tricks

Beyond the basics, there are a few extra tricks worth knowing. If you have international subscriptions, understanding PayPal’s currency conversion fees and managing your currency preferences can save you some real cash. Here's a useful resource on how currency conversion works with PayPal. Also, did you know you can sometimes leverage rewards programs by routing payments through specific cards? It's like getting a little bonus for managing your money wisely. Finally, for businesses looking to get more customers on board with automatic payments, think about offering small incentives like discounts or exclusive content. It can really boost adoption rates.

These advanced strategies can make a real difference in how efficiently you manage your finances. It's about moving beyond simply automating and actually using these systems to improve your overall financial well-being. Isn't that the whole point?

Your Automatic Payment Implementation Roadmap

Alright, so you're ready to dive into the world of automatic payments. Let's map out how to make this work for you. This isn't a one-size-fits-all kind of deal; it's more like a choose-your-own-adventure for your finances. Whether you're juggling a couple of subscriptions or a whole mountain of them, this guide will help you navigate the process.

Phase 1: Building Your Payment Foundation (Week 1)

First things first: get your PayPal account in tip-top shape. Make sure your preferred payment methods are verified and linked. Seriously, set up that backup funding source – it’s a lifesaver if your primary card decides to expire right before a payment is due. And while you're at it, tweak those notification settings. You want to stay informed, not buried alive in emails.

Phase 2: Dipping Your Toes in the Automation Waters (Weeks 2-4)

Start small. Pick a low-stakes automatic payment to test the waters. Think a free trial for something like Spotify or Netflix. This lets you see the system in action without risking any real cash. It’s like a test drive for your finances. Plus, you can catch any notification glitches early on. If you're looking for ways to make managing automatic payments even smoother, checking out some business automation solutions can be a game-changer.

Phase 3: Leveling Up Your Automation Game (Weeks 5-8)

Now that you've got the basics down, start automating more significant payments. Essential business subscriptions, recurring household bills – those kinds of things. This is where having a central payment command center really pays off. Whether it's a detailed spreadsheet, a budgeting app, or even a notebook, keep a close eye on it during this phase. Trust me, seeing all those payments handled automatically starts to feel pretty amazing. You'll have more time and mental space for other things – guaranteed.

Phase 4: Becoming an Automation Master (Ongoing)

You’re in the home stretch! The key here is regular review. Set calendar reminders to check your automated payments. Are you actually still using all those services? Are there better deals out there? Also, think about refining your payment timing to optimize your cash flow, especially if your income fluctuates. This is where you really start to use automatic payments strategically to improve your overall financial well-being.

Remember, even with automation, staying organized is crucial. These phases give you a solid framework. Tweak them as needed. The whole point of this is to simplify your financial life, not make it more complicated.

Ready to take your Telegram community to the next level and turn followers into paying members? MyMembers makes it a breeze. Check it out today to see how you can streamline your membership management, automate payments, and focus on what you do best: creating awesome content.