Not long ago, UK businesses could get away with a rough guess of what it cost to land a new customer.That era is over.

With ad costs going through the roof and budgets getting tighter, precision is no longer a luxury; it’s a survival tool. Getting your customer acquisition cost calculation spot-on isn't just a "nice-to-have" metric anymore. It's the key to staying in the game.

Why UK Businesses Must Master CAC Calculation Now

07611c9b-64b3-4ebf-9566-2f1ff977a05e.jpg

The current economic climate in the UK has brewed a perfect storm for marketers. The old strategy of just throwing more money at ads to reel in new customers? It's becoming more unsustainable by the day. Companies are now being forced to look at every single pound spent, and understanding exactly what it costs to acquire a customer is the very first step.

This isn't just about general economic jitters. It's about real, measurable pressures that are hitting your bottom line right now.

The Squeeze of Advertising Inflation

The fight for digital ad space is more intense than ever. Costs on the big platforms—Meta, Google, TikTok—have shot up. This is partly because of higher demand, but also because tougher data privacy rules have made it much harder to target the right people.

This "adflation" means the same budget that got you 100 customers last year might only land you 70 today. If you don't have a crystal-clear customer acquisition cost calculation, you're flying blind, completely unaware of how much your marketing efficiency has tanked.

Relying on traditional transactional marketing and heavy paid media spend is becoming less effective and more costly. The focus must shift from pure acquisition to profitable acquisition.

The old playbook is officially obsolete. What used to work is now just a fast track to draining your marketing budget for fewer and fewer returns.

Navigating Tighter Budgets and Higher Targets

To make things worse, many UK businesses are seeing their budgets slashed for the first time in years, even while being expected to hit ambitious growth targets. This puts marketing teams in a tough spot: do more with less.

This isn't just a feeling; the numbers back it up. In 2025, the UK is seeing a massive spike in Customer Acquisition Cost (CAC), driven by economic headwinds and fierce competition. With the UK economy projected to grow by a mere 0.3% and consumer spending staying flat, brands like ASOS and Naked Wines are finding their old acquisition models are breaking down. This is forcing businesses to pivot hard towards loyalty, retention, and smart brand partnerships to keep growing. You can dig deeper into these market shifts and see how to reduce your customer acquisition cost on Tyviso.com.

Knowing your precise CAC is your secret weapon. It allows you to:

- Justify your budget: You can walk into any meeting with hard data showing exactly what it costs to win a new customer.

- Optimise your channels: See which channels bring in profitable customers and which ones are just money pits.

- Set realistic targets: Line up your growth goals with what's actually possible financially.

Without this number, you're not just guessing—you're gambling with the financial health of your entire business. Mastering your customer acquisition cost calculation is the only way to make sure every marketing pound you spend is an investment, not just an expense.

Tracking Every Penny for an Accurate CAC Figure

979e563f-474f-4e52-966e-b566af09b210.jpg

The accuracy of your Customer Acquisition Cost is only as good as the data you feed it. I've seen it time and time again: a business proudly shows off a low CAC, only to realise they've only been tracking their monthly ad spend. It's a dangerously misleading picture.

To get a true understanding, you need to track every single penny that goes into winning a new customer. Anything less gives you a false sense of security, leading to shaky budget decisions and growth strategies that are built on sand.

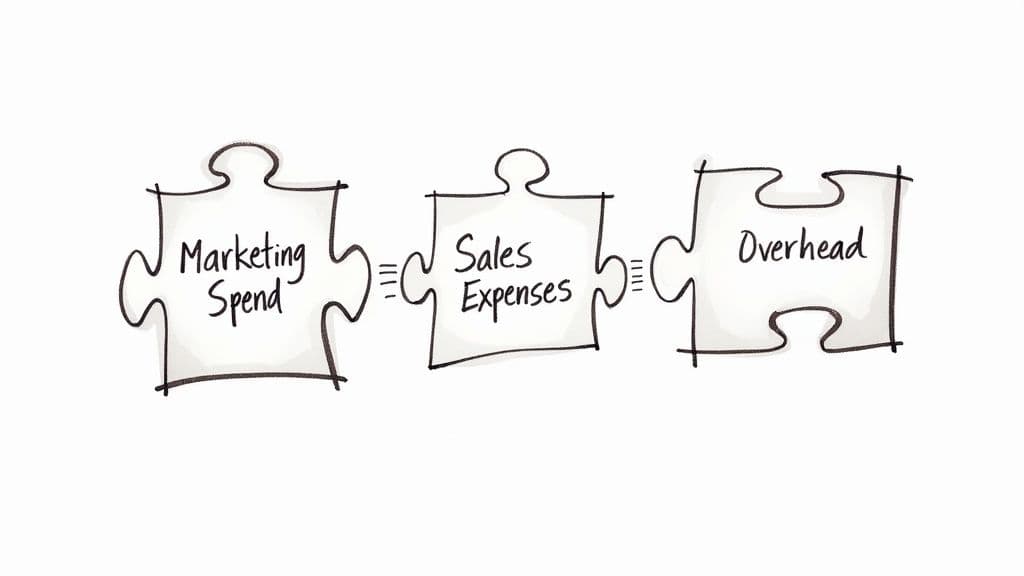

Identifying Your Core Sales and Marketing Costs

The obvious starting point is your direct ad spend. This is everything you pour into platforms like Google Ads, Meta, LinkedIn, or any other paid media channel. It's your baseline, but honestly, it's just the tip of the iceberg.

Next, you have to factor in the people. The salaries and benefits for your sales and marketing teams are a huge part of your acquisition investment. Don't just dump the entire payroll in; you'll need to work out what percentage of their time is spent hunting for new customers versus what's spent looking after existing ones.

Your CAC figure has to reflect the total investment needed to turn a prospect into a paying customer. Skipping costs like software subscriptions or staff salaries isn't just a small mistake; it's a fundamental error that will completely distort your business's financial reality.

For laser-focused insights, using effective marketing attribution is non-negotiable. Sophisticated platforms can show you which channels are actually doing the heavy lifting in bringing in customers, helping you allocate costs where they belong. This stops you from accidentally overvaluing a flashy but ineffective channel.

Uncovering the Often-Missed Expenses

Most businesses stop at ads and salaries. This is where the real trouble begins, because the "hidden" costs can easily inflate your true CAC and catch you by surprise. These are the expenses that often slip through the cracks but are absolutely critical for an honest calculation.

To get this right, you need a comprehensive view of all your outgoings. Here’s a checklist to make sure you're not forgetting anything important.

Essential Cost Components for CAC Calculation

This table breaks down the common—and often overlooked—costs you need to include for a truly accurate CAC figure.

| Cost Category | Specific Examples | Why It's Important |

|---|---|---|

| Direct Ad Spend | Google Ads, Meta Ads, LinkedIn Ads, Display Ads, Paid Influencer Posts | These are the most direct acquisition costs. Leaving them out is like trying to bake a cake without flour. |

| Salaries & Benefits | Salaries, commissions, bonuses, and benefits for marketing and sales teams | Your team's time is a massive investment. You must attribute the portion dedicated to acquiring new customers. |

| Content & Creative | Freelance writer fees, video production, graphic designer costs, stock photo licences | Content isn't free. The cost to create the assets that attract customers belongs in your CAC. |

| Software & Tools | CRM subscriptions (e.g., HubSpot), email platforms (e.g., Mailchimp), SEO tools (e.g., Ahrefs), analytics software | The tech stack that powers your acquisition engine has a clear price tag that needs to be included. |

| Overheads & One-Offs | PR agency retainers, event sponsorships, trade show costs, promotional materials | These campaign-specific or overhead costs can be substantial and directly contribute to winning new business. |

These indirect costs add up much faster than you think. A SaaS company, for example, absolutely must include the server costs for running free trials. Likewise, an e-commerce brand needs to account for expenses like product photography and the value of any "welcome" discounts used to hook first-time buyers.

By meticulously tracking both the obvious and the hidden expenses, your customer acquisition cost calculation is no longer a vague guess. It becomes a powerful diagnostic tool. This is the only way to genuinely understand the financial health of your customer acquisition engine and make sharp, informed decisions that fuel profitable growth.

Putting The CAC Formula Into Practice

Alright, you've got your cost data. Now for the fun part: the actual customer acquisition cost calculation.

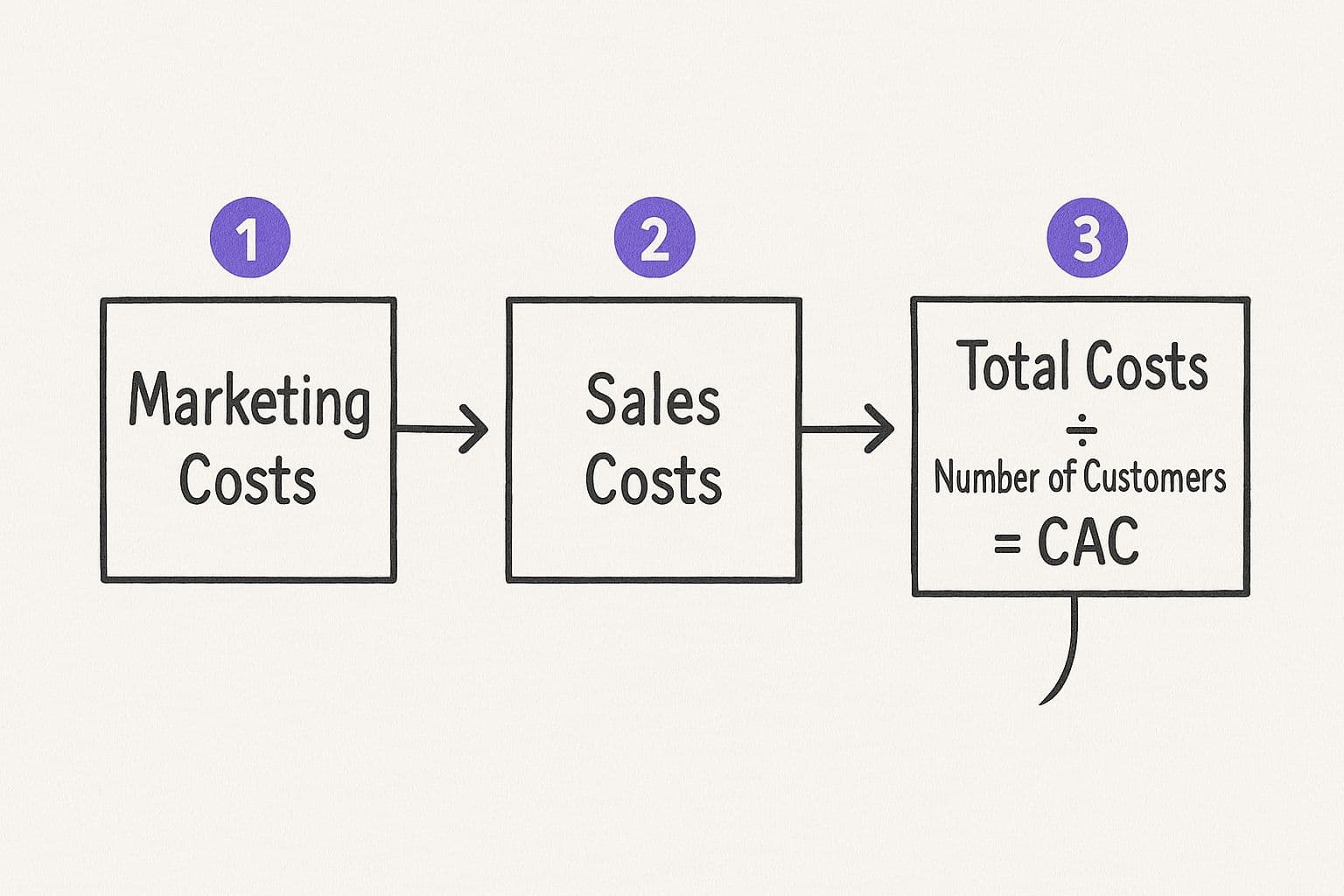

The formula itself is refreshingly simple: Total Marketing & Sales Costs divided by the Number of New Customers Acquired. But the real skill? It's in applying it correctly and reading between the lines of the numbers you get.

Let's make this real. Imagine a UK-based subscription box company, "Artisan Treats," looking at their performance over a single quarter (Q1). They need to know exactly how much it cost them to win each new subscriber during that period.

The whole process is pretty straightforward, breaking down into a few core pieces.

f0f348e7-a273-482f-8127-cbd486a79cda.jpg

This visual really just shows how we bundle up all the marketing and sales expenses before dividing by the new customer count to find our CAC. It’s a direct path from raw costs to an insight you can actually use.

Tallying The Total Costs

First up, Artisan Treats needs to add up all their relevant marketing and sales expenses from Q1. This isn't just about ad spend; it's the whole picture. Based on what we've talked about, their list looks something like this:

- Paid Advertising: £10,000 spent across Meta and Google Ads.

- Marketing Salaries: £12,000 for their two-person marketing team.

- Content Creation: £1,500 paid to a freelance food photographer for killer product shots.

- Software Tools: £500 for their email marketing platform and analytics software.

Add it all together, and their total marketing and sales cost for Q1 is £24,000. This number is their total investment in growth for that specific window.

Defining and Counting New Customers

The next step is mission-critical: counting the number of new customers they acquired. The distinction is vital. Returning customers or existing subscribers who just renewed their plan? They don't count here. If you include them, you’ll artificially deflate your CAC and get a false sense of security.

After digging into their data, Artisan Treats confirms they signed up 300 brand-new subscribers in Q1. Now they have both pieces of the puzzle.

Time to plug the numbers into the formula:

£24,000 (Total Costs) / 300 (New Customers) = £80 CAC

There it is. On average, it cost Artisan Treats £80 to acquire each new subscriber in the first quarter. This single number becomes the baseline for everything that comes next.

A single CAC figure is a great start, but context is everything. The smartest businesses I know calculate different versions of CAC to understand performance from every possible angle.

Fully Loaded vs. Paid Marketing CAC

That £80 figure is what we call a "fully loaded" CAC. It's the most honest number because it includes all the associated costs, from salaries to software. This is the one your finance team cares about for high-level planning. It’s the true cost.

But a performance marketer? They'll also want to calculate a "paid marketing" CAC. This version is much narrower, only including direct ad spend.

For Artisan Treats, that looks like:

£10,000 (Ad Spend) / 300 (New Customers) = £33.33 Paid CAC

This leaner figure is incredibly useful for judging the raw efficiency of your ad campaigns. It helps answer the question: "For every pound we put directly into ads, are we getting a customer back at a good price?"

Using both calculations gives you a much richer, more complete picture of your acquisition health. One tells you the true business cost, the other tells you how well your campaigns are firing. You need both.

Benchmarking Your CAC Against UK Industry Averages

So, you’ve wrestled with spreadsheets and tracked down your marketing spend. You’ve finally got a number for your customer acquisition cost. Great.

0535581c-fb2c-4d08-9b0c-b3d4510acae2.jpg

But on its own, that number is just a figure without a story. Is a £80 CAC a win, or a disaster waiting to happen? The real answer: it completely depends on your business model and, crucially, your industry.

To figure out if your acquisition efforts are actually healthy, you need to compare your CAC to your Customer Lifetime Value (LTV). That’s the total amount of money you expect to make from a single customer over your entire relationship. The CAC to LTV ratio is what tells you if your investment is paying off.

The Golden Ratio of Growth

There's a widely accepted benchmark that separates sustainable businesses from those running on fumes: a CAC to LTV ratio of at least 1:3.

What does that mean? For every £1 you spend to get a customer through the door, you should expect to get at least £3 back over their lifetime. Simple.

If your ratio is 1:1, you’re just breaking even. You have zero profit to reinvest in growth. Worse, if it's below 1:1, you’re actively losing money on every single customer you sign up. Aiming for that 1:3 mark (or higher) is a powerful sign that you've built a profitable and scalable business.

For anyone running on recurring revenue, tweaking your model by exploring different subscription model best practices can directly boost your LTV and make this critical ratio much healthier.

A single CAC figure is a vanity metric. The CAC to LTV ratio is a sanity metric. It's the real measure of whether your growth engine is built to last or destined to run out of fuel.

Understanding this ratio transforms your CAC from a basic expense into a sharp piece of business intelligence. It’s what helps you justify your marketing budget and prove the long-term value of your strategy.

How You Stack Up in the UK Market

Context is everything. A 'good' CAC varies massively between sectors here in the UK. The cost and complexity of acquiring a customer are deeply tied to things like sales cycle length, deal size, and market competition.

For example, 2024-2025 data shows that UK sectors with long, resource-intensive sales cycles naturally have much higher acquisition costs.

- The average CAC for a Legal Services firm is around £610.

- Manufacturing is not far behind at £590.

- Meanwhile, IT & Managed Services sit around £370.

- Pharmaceuticals report a much lower CAC near £153.

These figures make it obvious that comparing a law firm’s CAC to a pharma company’s is pointless. You can dig into more of these varied customer acquisition costs on gocustomer.ai.

The real key is to benchmark against two things: your own industry and, even more importantly, your own history. Is your CAC trending up or down over the last few quarters? That’s the trendline that tells a much more important story than a single, static number ever could.

Actionable Strategies to Lower Your CAC

Once you’ve got a handle on your customer acquisition cost, you have a powerful lever to pull. The goal isn't to slash spending and slam the brakes on growth. It’s about working smarter. It’s about being more efficient.

And the pressure is on, especially for UK businesses. Ecommerce brands here are staring down a massive 40% rise in CAC between 2023 and 2025. That’s not just a number on a spreadsheet; it’s a direct hit to the bottom line.

While it might cost around £57 to get a new customer through the door, the real damage is worse. Many UK ecommerce firms are now losing about £23.50 on average for every single new customer they bring in. That trend is a screaming signal that business as usual won’t cut it anymore.

This isn’t about gutting your marketing budget. It’s about getting surgical and reallocating your cash to the channels and tactics that actually deliver a return.

Double Down on Conversion Rate Optimisation

You’re already paying to get eyeballs on your website and landing pages. The most direct path to a lower CAC is to simply convert more of those visitors into paying customers. Every little improvement here makes your existing ad spend work harder for you.

Think about it. A serious focus on Conversion Rate Optimisation (CRO) ensures more of your clicks turn into cash. This means getting obsessive about testing your headlines, call-to-action buttons, page layouts, and the entire checkout flow.

I saw this firsthand with a UK-based fitness coaching service. They had a huge drop-off on their sign-up page. They made two simple changes: the headline went from a vague "Start Your Journey" to a punchy "Get Your Personalised 7-Day Plan Now," and they slashed the form fields from six to three.

The result? An 18% jump in their conversion rate. Their ad spend didn’t change by a single pound, but their CAC plummeted because they were closing more of the traffic they already had.

Shift Focus From Acquisition to Retention and Referrals

Sometimes the cheapest new customer is the one you didn’t have to pay for at all—the one brought in by an existing, happy member. Pouring resources into retention isn’t just about boosting lifetime value; it’s a beast of a CAC reduction tool.

The most profitable marketing you can do is the kind your existing customers do for you. A strong referral programme can become your most efficient acquisition channel.

Set up a simple, rewarding referral programme. Give your current members a real benefit—like a free month, a hefty discount, or exclusive content—for bringing someone new into the fold. This instantly turns your loyal base into a low-cost, high-trust sales force. Their endorsement is more authentic and powerful than any ad you could ever run.

This is where the relationship between CAC and LTV really clicks. When you keep customers around longer, their lifetime value soars, which gives you more breathing room on your acquisition spend. To see exactly how these two metrics dance together, you can dig into our guide on using a lifetime value calculator. A higher LTV can justify a higher CAC, sure, but a killer referral programme helps you lower it anyway.

Invest in Organic, Long-Term Channels

Paid ads get you results fast, but they’re like a tap—the second you turn it off, the leads dry up. Investing in organic channels like SEO and content marketing is a long-term play, but it builds a sustainable, low-cost acquisition engine that works for you 24/7.

Start by creating genuinely helpful content that answers the burning questions your ideal customers are typing into Google. For instance, a London-based creator selling a Telegram course on digital art could write blog posts like:

- "Top 10 Procreate Brushes for Beginners"

- "How to Price Your First Digital Art Commission"

This kind of content attracts potential customers organically. Yes, it takes time to rank. But once a post gains traction, it can generate leads for months or even years with almost zero ongoing cost. That’s how you drastically lower your blended CAC over time.

Got Questions About Your CAC? We've Got Answers

Alright, so you’ve got the customer acquisition cost formula down. That’s the easy part. But once you start plugging in real numbers, the practical questions hit you fast. It’s one thing to know the theory, but it’s another to actually use it without falling into common traps.

Let's get into the nitty-gritty questions we hear all the time. Getting these right will make your CAC analysis genuinely useful.

First up: "How often should I even be running these numbers?" There’s no single magic answer, but for most businesses, a monthly calculation is the sweet spot. Doing it monthly gives you a responsive, up-to-the-minute feel for what’s working and what’s not. You can spot a bad trend and kill a failing campaign before it bleeds you dry.

Quarterly calculations are solid for seeing bigger, more stable patterns, while an annual look is great for high-level financial planning and showing investors the bigger picture. The real key? Just be consistent. Pick a schedule and stick to it.

CAC vs. CPA: What's the Difference, Really?

This one trips a lot of people up. Customer Acquisition Cost (CAC) and Cost Per Acquisition (CPA) sound the same, but they measure completely different things. Getting this wrong can give you a dangerously false sense of security.

- CPA (Cost Per Acquisition/Action): Think of this as a tactical, micro-metric. It’s the cost of a specific action. This could be a click, a lead, a free trial sign-up, or a form submission. It’s almost always tied to a single campaign or channel.

- CAC (Customer Acquisition Cost): This is your big-picture, strategic number. It measures the total, all-in cost to get a new paying customer. It includes all your sales and marketing expenses, not just the ad spend from one campaign.

Here’s a real-world example: Your CPA to get someone to sign up for your free newsletter might be a tidy £2. But if only 1 in 25 of those subscribers ever becomes a paying member, and you spent £100 total on marketing that month to get those 4 new customers, your CAC is actually £25.

Understanding the difference is everything. CPA helps you tweak individual campaigns for efficiency. CAC tells you whether your business model is actually profitable. A great CPA doesn't mean a thing if your CAC is unsustainable.

How Do I Figure Out CAC for Different Channels?

Okay, this is where it gets a little messy, but it’s also where the most valuable insights live. How do you figure out the CAC for a specific channel like Google Ads versus your organic SEO efforts? You’ve got to get good at attributing your costs.

For paid channels, it’s pretty straightforward. You take the direct ad spend for that channel and divide it by the number of new paying customers who came from it. Easy.

For organic channels like SEO or content marketing, it’s more of an art. You need to allocate a percentage of your content team's salaries, your SEO tool subscriptions (like Ahrefs or Semrush), and any other related overheads. It’s not a perfect science, but even a well-reasoned estimate gives you a much clearer view of which channels are truly driving profitable growth.

Focusing on channel efficiency is a huge part of building a sustainable business. It's also deeply connected to keeping the customers you already have; our guide on customer retention best practices dives into how keeping members happy lowers the constant, expensive pressure to acquire new ones.

Ready to turn your Telegram community into a profitable business? MyMembers makes it easy. Set up paid memberships, manage subscriptions, and watch your revenue grow—all with no code required. Get started with MyMembers today and monetise your passion.