Right, let's get into it. Monthly Recurring Revenue (MRR) is the lifeblood of any subscription business. It’s the predictable cash you can count on hitting your bank account every single month.

The basic formula is dead simple: Total Customers x Average Revenue Per User (ARPU).

The Ultimate Guide to Calculating Monthly Recurring Revenue

39b8994a-6743-4912-876b-2d937cc957fc.jpg

Getting a handle on your MRR is more than just a box-ticking finance task. It's about getting a real-time snapshot of your company's health and where it's heading. Before we jump into the numbers, understanding the different subscription business models is crucial. It gives you context for how this predictable revenue is actually generated, whether you're running a SaaS platform or a creator community.

The core principle is always the same: track the income you know is coming in.

For UK businesses, especially in e-commerce and SaaS, tracking MRR isn't just a good idea—it's a top priority. It's seen as a core indicator of both your current health and your future valuation. A proper MRR calculation doesn't just look at new sign-ups; it has to include everything—upgrades, downgrades, and the customers you lose along the way. It’s the only way to get the full financial picture.

Breaking Down the Components of MRR

To really understand what’s driving your growth, you have to look past the top-line number. MRR is made up of a few key pieces, and each one tells a different part of your business's story.

Key Takeaway: Tracking the individual bits of MRR—like New, Expansion, and Churn—gives you real, actionable insights into what your customers are doing, what they think of your product, and your overall business momentum.

This table breaks down the key components of MRR to help you understand what drives your monthly revenue figures.

The Four Pillars of MRR Growth

| MRR Component | What It Measures | Business Implication |

|---|---|---|

| New MRR | Revenue from brand-new customers in a given month. | Shows you how well your sales and marketing efforts are actually working. |

| Expansion MRR | Extra revenue from your existing customers (think upgrades or add-ons). | A direct reflection of customer happiness and how good your upselling game is. |

| Churn MRR | The revenue you lose when customers cancel or downgrade. | A massive red flag for potential problems with your product, pricing, or support. |

| Net New MRR | The sum of New and Expansion MRR, minus your Churn MRR. | This is it. The ultimate measure of whether your company is actually growing month-on-month. |

When you put these four pillars together, you get a clear, unfiltered view of your business's trajectory. It’s not just a number; it’s a story about your wins, your losses, and exactly where you need to focus your energy next.

Getting Your Data Straight for a Real MRR Figure

Let’s be honest. Any monthly recurring revenue calculator is only as smart as the data you feed it.

It’s the classic "garbage in, garbage out" problem. If you want a real snapshot of your business's health, you have to get disciplined about collecting the right numbers and ruthlessly cutting out the noise. This isn't just about counting customers; it's about separating your predictable, recurring income from everything else.

First things first, you need a clean list of what actually counts.

Here's what to round up:

- Active Subscribers: The total number of customers who are actively paying you on a recurring plan.

- Revenue by Tier: The monthly income you're getting from each of your different subscription plans.

- Recurring Add-ons: Any extra cash from things customers pay for every single month, not just once.

Getting this right means being brutally honest about what truly repeats every month.

What You Absolutely Must Exclude from Your MRR

Just as vital is knowing what to leave out. Tossing non-recurring cash into the mix gives you a dangerously rosy picture of your finances. It's a surprisingly common mistake, but thankfully, an easy one to sidestep.

Critical Tip: Imagine a UK-based Shopify store selling subscription boxes. They have to keep their predictable monthly box revenue completely separate from one-off "gift box" sales. If they mixed the two, their financial forecast would be a mess, and they'd get a false sense of stability.

Make sure you're excluding these usual suspects:

- One-time setup fees

- Trial users (even if they’re on a paid trial)

- Usage or overage charges

- Late payment fees or other admin charges

When you meticulously organise your data before you even touch a calculator, you're setting yourself up for an accurate result. This kind of data hygiene is way less painful when you're using a platform that automates member management. The best recurring billing software will often distinguish between different revenue streams for you, which is a massive help.

Ultimately, this foundational step isn't negotiable if you're serious about tracking growth. Your final MRR number will only ever be as trustworthy as the data you put in.

Putting The MRR Formula Into Practice

Knowing the formula is one thing. Applying it to your business’s real, sometimes messy, numbers is where the real learning kicks in. Let's walk through how this works in the wild, moving from theory to tangible figures.

Imagine a B2B SaaS company based in Manchester. They offer three different pricing plans. To get a real grip on their MRR, they can't just mash all the numbers together. They need to break it down.

- Basic Plan: 100 customers paying £29/month = £2,900 MRR

- Pro Plan: 50 customers paying £79/month = £3,950 MRR

- Enterprise Plan: 10 customers paying £249/month = £2,490 MRR

Add these up (£2,900 + £3,950 + £2,490), and the company’s total MRR comes out to £9,340. This simple breakdown gives them so much more clarity than a single, blended average. It shows them exactly which plans are pulling their weight.

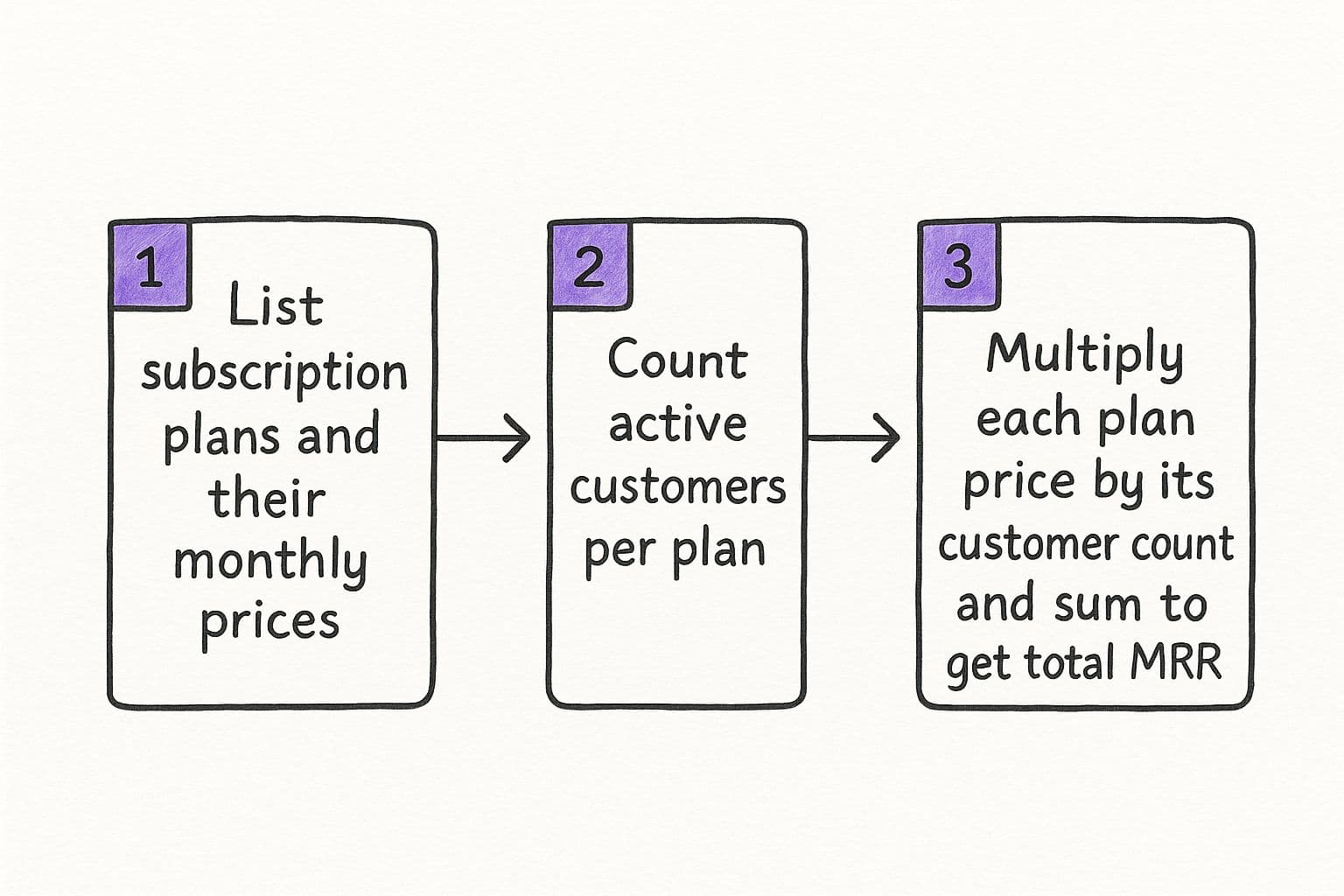

This is the basic flow for any business with multiple subscription tiers.

d426304a-fec4-4837-90c9-b6476b3feb96.jpg

As you can see, it’s a logical process: list your plans, count the active customers on each, and sum it all up. Following this structure helps avoid mistakes and makes sure every bit of revenue gets counted.

Normalising Different Billing Cycles

Okay, but what about non-monthly payments? This trips a lot of people up.

Let's take a consumer subscription box service in London. To encourage longer commitments, they offer a quarterly plan at £60. You can’t just dump that full £60 into your MRR calculation for the month they pay. That would completely throw off your numbers and make your growth look artificially spiky.

Crucial Tip: You have to normalise non-monthly payments to a monthly value. For a £60 quarterly plan, you divide by three. This customer contributes £20 to your MRR each month, not £60 in one go and £0 for the next two.

Getting this normalisation right is fundamental for a stable, predictable metric. The same logic applies to semi-annual and annual plans—just divide the total by six or twelve.

Another classic mistake is how you handle discounts. If you give a new customer 50% off a £50/month plan for their first three months, their MRR contribution during that promo period is £25, not the full £50.

Using a proper monthly recurring revenue calculator or a dedicated platform automates these fiddly bits. It ensures your final number reflects the actual cash you can expect, not just the prices on your website.

Why Nailing Your MRR Is A Game-Changer For Your Business

6ec80ddf-468a-42ea-b0f0-3f185b25ce09.jpg

Getting your monthly recurring revenue (MRR) right is so much more than a box-ticking admin chore. For any UK subscription business, it’s the lifeblood of your strategy.

Think of it as the single most important story you can tell about your business's health. It directly impacts your ability to pull in investment, get an accurate valuation, and keep the books clean.

When you're out there looking for funding, investors—especially in hubs like London and Manchester—live and die by this metric. A clean, upward-trending MRR chart screams momentum and market fit. Honestly, it's often the very first thing they’ll ask to see.

The Bedrock of Valuation and Compliance

Beyond just wooing investors, accurate MRR is absolutely fundamental to your business's valuation. It gives you a clear, predictable measure of financial performance that’s miles more compelling than sporadic, one-off sales. That predictability is precisely what stakeholders and potential buyers pay a premium for.

And let’s not forget compliance. UK accounting standards are pretty clear: you need to recognise revenue as you deliver the service, which for most subscription models means monthly. Getting this right is crucial for accurate financial statements and is another key area investors will dig into.

The Bottom Line: A powerful combination of steady MRR growth and low customer churn creates an undeniable story of a sustainable, investment-worthy business. It transforms your financial data into a compelling argument for your company’s long-term potential.

This focus on sustainable income is a core principle behind successful membership businesses. You can see how different models achieve this by exploring various subscription pricing examples.

Ultimately, getting your MRR right isn’t just good bookkeeping; it’s the foundation of your entire growth strategy.

Turning Your MRR Data Into Actual Growth

Right, so you've got your Monthly Recurring Revenue (MRR) number. Don't stop there. That figure is the starting pistol, not the finish line. The real magic happens when you use that data to make smarter decisions, moving beyond just plugging numbers into a calculator and becoming a leader who actually understands their own business.

Think of it this way: digging into your MRR trends helps you see the future. You can forecast revenue with terrifying accuracy, pinpoint which customers are secretly your most valuable, and spot the early warning signs of trouble, like a slow creep in your churn rate.

For example, if your Expansion MRR has gone flat, that’s a massive, flashing red light. It's screaming at you to double down on upselling. Maybe that means building out new premium features, offering exclusive add-ons, or simply getting better at showing existing customers why your top tiers are worth the money.

Finding the Levers That Actually Move the Needle

Different bits of your MRR tell you where to put your energy. A weak New MRR, for instance, points a big, fat finger directly at the top of your funnel. It's time to get brutally honest about your marketing campaigns and sales process.

By the way, it's not just about the final calculation. Nailing your SaaS demo best practices can have a huge impact on both new and expansion revenue. A polished demo that screams "value" is an insanely powerful tool for both winning new business and convincing old customers to upgrade.

You can't use the same strategy to fix every problem. The approach has to be targeted:

- To crank up New MRR: Get your marketing message razor-sharp, fix your sales demos, or maybe play with some entry-level pricing to make it a no-brainer for new folks to sign up.

- To pump up Expansion MRR: This is all about tiered pricing, creating add-ons people actually want, and actively talking to your customers to figure out what they need next.

- To slash Churn MRR: Beef up your customer support, actually listen to user feedback (and act on it), and think about loyalty programmes that make people want to stick around.

This isn't about guesswork. It's about making strategic moves based on solid data. The whole point is to build a predictable growth engine, and understanding these levers is how you do it. To really get this right, you need to build strong habits, which we break down in our guide to subscription model best practices.

This kind of strategic focus is paying off big time across the UK. Just look at one major European software company that saw its MRR climb to €2.3 million, with the UK and EMEA region alone surging by 32.0%. That growth didn't happen by accident. It was fuelled by a deliberate shift to subscription models and locking in new contracts, proving just how hungry the market is for recurring revenue.

Common Questions About Calculating MRR

00573700-4446-4e4c-96f1-c294096a72ee.jpg

Even when you have the formula down, calculating monthly recurring revenue can still throw you a few curveballs. Real-world scenarios have a way of making simple maths feel complicated. Let's clear up a couple of common spots where people get tripped up.

One of the biggest head-scratchers? Annual contracts.

Say a customer pays you £1,200 upfront for a year's access. It's tempting to pop that into the month you got paid, but that’s a mistake. You have to normalise it. Divide the total by 12, which means you'll add just £100 to your MRR for each month of that contract. It's about predictable revenue, not one-off cash spikes.

Another classic point of confusion is paused subscriptions. If a customer hits the brakes on their plan for a few months, they need to come out of your MRR calculation completely. They're not generating any recurring revenue until they're active again. Simple as that.

MRR vs Cash Flow: What Is the Difference?

This is a big one, so listen up: MRR is not the same as cash flow. Getting this wrong can seriously mess up your financial planning.

MRR is your pulse. It’s a normalised metric that tracks predictable, recurring revenue, making it perfect for measuring growth and momentum. Cash flow, on the other hand, is the actual cash moving in and out of your bank account.

Let's go back to that customer who paid £1,200 upfront. Your MRR for them is a steady £100 per month. But your cash flow shows a fat +£1,200 in month one, followed by eleven months of £0 from that same customer.

See the difference? One tracks health, the other tracks liquidity.

Getting this distinction right is absolutely key. Using a dedicated monthly recurring revenue calculator is a great way to keep these two concepts separate and give you a true picture of your business's sustainable growth.

Transform your Telegram community into a predictable income stream with MyMembers. Set up automated recurring payments, manage your members, and track your revenue growth all in one place. Get started in minutes at https://mymembers.io.