Trying to compare payment processing fees can feel like you’re reading a different language. But when you boil it all down, there are really only three charges that UK businesses need to worry about with every single transaction.

Once you get your head around these, you’ll see why the headline rate a payment processor advertises is almost never what you actually end up paying.

Understanding UK Payment Processing Fees

3ab3a54b-49e6-42b1-88bb-ae5482185c0b.jpg

When you take a card payment, the total fee you pay isn't just one single charge. It’s a blend of different costs that get bundled together. Cracking this code is the first step to choosing the right payment partner for your business.

These fees hit your profit on every single sale. Let’s break down what each one actually is and why it matters.

The Three Core Fee Components

- Interchange Fees: This is the big one. It’s the largest chunk of the total fee and goes from your business’s bank (the acquirer) to your customer’s bank (the issuer). Think of it as compensation to the customer's bank for taking on the risk of the transaction. The rate changes depending on the card type (debit vs credit, premium vs standard) and how the payment is made (online vs in-person).

- Scheme Fees: This is the cut taken by the card networks themselves, like Visa and Mastercard, just for using their rails. For UK merchants, these fees have been a major source of rising costs over the past few years.

- Acquirer's Markup: This is the bit your payment processor (like Stripe or PayPal) adds on top. It’s their profit margin and covers their own costs for tech, support, and everything else. This is where you’ll see the biggest difference between providers.

Unfortunately, these costs never seem to stand still. Between 2017 and 2025, Mastercard and Visa jacked up their core scheme fees by at least 25%. This sneaky increase is piling an estimated £170 million in extra costs onto UK businesses every single year, hitting profits directly.

Here's the key takeaway: This three-part fee structure is exactly why two businesses using the same payment processor can have completely different effective rates. Their mix of customers, card types, and transaction risk all play a huge role.

This is especially critical for anyone monetising a community or creative project. Before you even think about how to sell content online, you need to get a grip on these fees. It’s the only way to pick a payment partner that actually fits your model, whether you're selling one-off digital products or managing hundreds of recurring subscriptions.

Comparing the Top UK Payment Processors

Picking a payment processor in the UK feels like it should be simple. But once you look past the shiny homepage rates, things get complicated fast. All the big players—Stripe, PayPal, Square, and Revolut Business—have solid offerings, but their fee structures are where the real story is. A proper comparison means digging into the nitty-gritty of transaction costs, sneaky monthly fees, and what happens when you sell to someone outside the UK.

For creators monetising communities on platforms like Telegram, these details are everything. Get it right, and your business scales smoothly. Get it wrong, and you’ll find your revenue slowly bleeding out from a thousand tiny cuts.

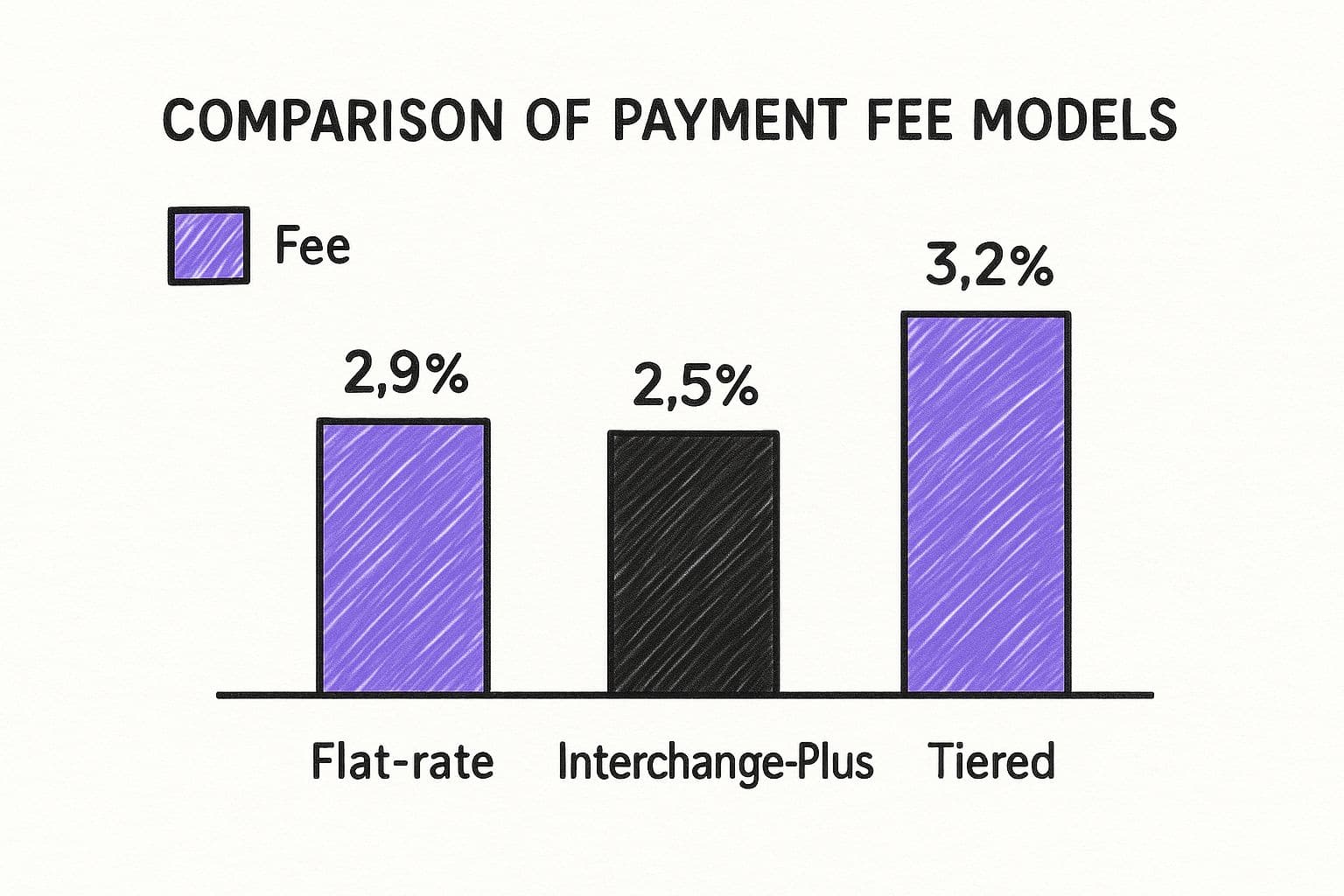

This image shows you just how different fee models can hit your bottom line.

db1d4348-6e7c-45a3-aa5e-c0167b8cdbec.jpg

As you can see, a small percentage difference between a flat-rate and an interchange-plus model isn't so small when you zoom out. Over time, those pennies add up to serious money.

Let’s take a look at the key fee structures for the top UK payment processors to help you decide which is the right fit for your business.

UK Payment Processor Fee Structure Comparison

| Feature | Stripe | PayPal | Square | Revolut Business |

|---|---|---|---|---|

| Standard UK Card Fee | 1.5% + 20p | 1.2% + 30p | 1.4% + 25p | 1% + 2p (for paid plans) |

| International Card Fee | 2.5% + 20p (EU cards) | 2.9% + 30p + currency fees | 2.5% | 2.8% + 2p (for paid plans) |

| Monthly Fee | £0 (Standard) | £0 (Standard), £20 (Pro) | £0 (Standard) | £0 (Free), £19+ (Paid) |

| Chargeback Fee | £15 (if dispute lost) | £14 | £0 (with protection) | £15 |

| Currency Conversion Fee | 2% on top of transaction fee | 3% above base exchange rate | 2.5% for international cards | Varies by plan |

This table gives a bird's-eye view, but the best choice always depends on your specific situation—like your average sale price and where your customers are located. A low percentage fee might look great, but a high fixed cost can hurt if you’re selling low-ticket items.

Transaction Fees: A Side-by-Side Look

The fee you see on the pricing page is just the start. The real cost per transaction is a moving target, changing based on the type of card your customer uses and where they are in the world. This is where most creators get caught out.

For instance, Revolut Business advertises a slick 1% fee for UK Visa and Mastercard transactions, but that jumps to 1.7% for Amex cards, and both come with a 2p fixed fee. Meanwhile, Stripe charges a higher 1.5% + 20p for UK cards, which then leaps to 2.5% + 20p for European cards.

Key Insight: A processor with a low percentage isn't automatically the cheapest. That 20p fixed fee from Stripe can make it more expensive than Revolut for small transactions, a common scenario for creators selling digital guides or access to a one-off event.

This gets even more important if you run on recurring revenue. If you're focused on building a subscription website, those tiny percentage differences get magnified across hundreds or thousands of monthly payments.

Monthly Costs and Account Fees

After transaction fees, you need to scout for fixed monthly costs. Most processors lure you in with a free basic plan, but as soon as you need more advanced features, you’ll find yourself reaching for your wallet.

- Stripe: Famously has no monthly fees for its standard plan. You pay as you go, which is a dream for businesses with unpredictable sales.

- PayPal: The standard account is free. But if you want a more integrated checkout experience with PayPal Payments Pro, that’s £20 a month.

- Square: Works like Stripe, with no monthly fees for its standard online payment services. You just pay a flat rate when you make a sale.

- Revolut Business: This one is tiered. They have a free plan, but to get the best rates and features, you’ll need a paid plan starting from £19 per month.

You have to bake these fixed costs into your calculations. A monthly fee can easily wipe out any savings you thought you were making from a slightly lower transaction rate, especially if your sales volume is still growing.

International Payments and Chargebacks

If you have a global audience—and most online creators do—you absolutely cannot ignore cross-border and currency conversion fees. This is where processors often make their real money.

Stripe, for example, tacks on an extra 2% for currency conversion if needed. PayPal charges an additional fee of up to 1.50% for most international commercial transactions on top of their conversion costs.

Then there are chargebacks. This is when a customer disputes a payment with their bank. It’s a headache, and it costs you money. Stripe hits you with a £15 fee for every dispute you lose. PayPal’s is similar at £14. These penalties can stack up quickly, making a processor's dispute support an often-overlooked but critical feature.

Uncovering the Hidden Costs of Payment Processing

26891c9f-08fe-42f5-af84-866cb017f777.jpg

Focusing only on the big, flashy transaction percentage is the classic mistake. It's an easy trap to fall into, but it's a costly one. To really understand what you'll be paying, you need to dig into the small print. That’s where the real costs are hiding, and they can seriously eat into your revenue.

A lot of creators get a nasty surprise when they start selling internationally. On top of the standard fee for an international card, many providers quietly add their own currency conversion markup. So, they might skim an extra 1-2% off the top just to turn US dollars into British pounds. That fee gets stacked right on top of everything else.

Beyond the Percentage Rate

These sneaky fees aren't just about currency conversion. They pop up in all sorts of places, and they hit your profit margins directly—especially if you're building a business on recurring subscriptions.

Before you commit to any provider, you need to play detective and hunt for these costs:

- Chargeback Fees: When a customer disputes a payment and you lose, you don't just lose the sale. Most processors will sting you with a penalty fee, usually around £15-£20. It’s non-refundable, adding a financial kick when you're already down.

- PCI Compliance Fees: Some processors will charge you a monthly or annual fee just to say you meet the Payment Card Industry Data Security Standard (PCI DSS). Big players like Stripe or Square usually roll this in, but others bill it separately.

- Failed Payment Fees: Got a subscription model? If a member's payment fails because their card expired, some processors will still charge you for the failed attempt. This is a big reason why optimising your dunning settings is crucial when you're handling https://mymembers.io/blog/stripe-recurring-payments.

- Termination Fees: Watch out for contracts. Some providers lock you in and will hit you with a massive penalty if you try to leave before your term is up.

The real cost of payment processing is often a story told in the footnotes. A provider that seems cheap on the surface can quickly become expensive once you factor in charges for chargebacks, international sales, and other incidental fees.

The Administrative Burden

Hidden costs aren't just about money leaving your account. They’re also about the time you burn managing it all.

Think about it. Fighting a single chargeback means digging up evidence and submitting paperwork. That's time you could have spent growing your community or creating content. This is where looking at things like affiliate payment automation strategies can be a lifesaver, cutting down that manual admin and its associated costs.

Ultimately, a proper comparison of payment processing fees goes way beyond the advertised rates. You need to build a realistic cost model for your specific business. Factor in where your customers live, your average transaction size, and how often you might face disputes. Doing this homework ensures you find a partner that helps you grow, not one that quietly siphons off your revenue with fees you never saw coming.

Right, let's talk about payment processors.

Picking one for your Telegram or Discord community isn't like choosing one for a Shopify store. The game is totally different. Your whole decision hinges on how you’re actually making money—are you selling digital products, running recurring subscriptions, or just taking donations?

A payment processing fees comparison is a must, but you have to look at it through the lens of a community manager. Things like how well the API plays with your bots, fee structures that don’t kill your profits on small payments, and the user experience for your members become way more important. You need something that slots into your community's ecosystem without causing a headache.

Subscriptions vs One-Off Sales

Your sales model is the first fork in the road. Are you building a solid, recurring income with monthly access? Or are you selling one-off digital downloads like PDF guides or video courses? Each one demands a different tool.

- For Recurring Subscriptions: Stripe is almost always the smarter bet. Its API is a beast—powerful, clean, and built for the kind of automation you need for membership bots. It just works. You can set up a bot to automatically grant and revoke access based on payment status, and its recurring billing engine is baked in for free. That’s a huge win over others who nickel-and-dime you for subscription features.

- For One-Off Sales: This is where PayPal can shine. Its biggest advantage is trust. Everyone knows PayPal. For a simple, one-time purchase, that familiar button can slash friction and boost sales because millions of people can pay with a click, no new account needed.

Here's a critical bit of insight most people miss: the best processor for a £5 monthly subscription is probably the worst for a £50 one-off product. The fee structure hits your profits differently depending on the transaction size and how often it happens.

Think about it. A high fixed fee, like Stripe's 20p, is nothing on a big, single purchase. But on a small, recurring payment? That fee eats into your margin every single month. Getting this nuance right is the key to not leaking profit.

API Flexibility and Automation

In the Telegram and Discord monetization world, automation is everything. You can't be manually adding and removing members at 3 AM. Your payment system has to "talk" to your community bots to handle access, expirations, and removals without you lifting a finger. This is where the processor’s Application Programming Interface (API) becomes the make-or-break feature.

Stripe’s API is the undisputed king here. It’s clean, insanely well-documented, and flexible, which is exactly why platforms like MyMembers are built on it. It lets you create deep, custom integrations that automate the entire member lifecycle, from the first payment to nagging them about a failed renewal.

PayPal, on the other hand, can be a clunker. While its API has gotten better, it’s still more cumbersome for the complex logic you need for subscriptions. Then there’s the data portability issue—a massive red flag. Stripe lets you securely pack up and move your customer payment data if you ever want to leave. PayPal, historically, makes this a nightmare, effectively locking you into their platform. For a business built on recurring subscribers, that's a huge risk.

This makes Stripe the much safer long-term bet for any community business that relies on subscription income. You're not just choosing a payment tool; you're choosing your long-term business partner.

How Transaction Types Impact Your Fees

ec8e7fcd-f3d2-4da0-a0bb-5023f34115a5.jpg

Not every sale you make costs you the same in fees. The way your customer pays can seriously mess with your processing costs, and if you don’t get your head around this, you’re flying blind. It all boils down to one simple thing: perceived risk.

A fundamental line processors draw is between ‘card-present’ (in-person) and ‘card-not-present’ (online) sales. For creators monetising Telegram communities, basically every transaction you ever make falls into the higher-risk, ‘card-not-present’ bucket. This immediately puts you in a more expensive bracket than a physical shop because the risk of fraud is statistically much higher when the card isn't physically there.

Card-Present vs Card-Not-Present Fees

When a customer taps or pops their card into a terminal, the bank sees it as pretty secure. The physical card acts as a verification token. Simple.

Online, that physical security is gone. This is exactly why online transaction fees are always higher, no matter which provider you use. For your Telegram community, every single subscription or digital product sale is processed this way. You start the game in a pricier fee bracket by default.

Key Insight: Stop comparing your online rates to the ones advertised for high-street shops. Your business model is completely different, and payment processors price that risk directly into your fees. You are, and always will be, a 'card-not-present' merchant.

Credit vs Debit Card Costs

The type of plastic (or digital plastic) your members use also hits your bottom line. Banks charge higher interchange fees for credit cards than for debit cards. Why? Because credit transactions are essentially a tiny loan and carry a much higher risk of chargebacks.

In the UK, this difference is pretty stark. For in-person sales, credit card fees can be anywhere from 0.7% to 3.4%, while debit cards are much cheaper at 0.4% to 1.7%. While those numbers are for face-to-face payments, the principle is identical for online sales. Credit cards will consistently cost you more to process.

Domestic vs International Payments

Finally, where your customer is sitting matters. A lot. A payment from a UK-based member using a UK-issued card is a domestic transaction, and it’ll have the lowest possible fee.

But if a member pays with an international card (say, from the US or EU), processors will slap on a cross-border fee. This is often an extra 1-2% on top of your standard rate. If that transaction also needs currency conversion, guess what? Another fee gets added.

It’s crucial to know how these different factors can make your costs jump around. For instance, some platforms share important updates regarding increased blockchain fees for certain crypto payments. Being aware of all these variables is the only way you can forecast your actual costs with any real accuracy.

Right, let's nail down which payment processor is actually going to work for you.

This isn’t just about finding the rock-bottom lowest percentage. That’s a rookie mistake. The real win is picking the processor that costs you the least for how you actually operate.

How to Pick a Winner for Your Community

Think about your own setup for a second. What’s your typical transaction volume? What's your average sale price—is it a fiver for monthly access or a £200 course? And where are your members paying from? These three things will make or break your decision.

A processor that’s a dream for someone selling high-ticket courses can be a total nightmare for a community built on small, recurring payments.

Take Square, for example. Its 1.4% + 25p online rate looks simple and clean. For a new business, that simplicity is golden. But that 25p fixed fee? It’ll absolutely chew through your profits if you’re selling £5 monthly subscriptions, which is super common for Telegram communities.

Now look at Stripe. Its standard 1.5% + 20p rate might seem a touch higher at first glance. But its API is phenomenal, and the tools for managing subscriptions are second to none. For most community managers focused on automated, recurring revenue, Stripe is the logical choice. That slightly lower fixed fee makes a real difference on low-priced memberships.

Here’s the only step that truly matters: run the numbers for your business. Seriously. Open a spreadsheet, take your average sale price, and plug in the fees for your top two or three options. You'll see pretty quickly who's actually leaving more money in your bank account.

This simple exercise usually reveals a clear winner.

If your community is all about £5 monthly access, a processor with the lowest possible fixed fee is your hero. If you’re selling a one-off £200 course, the percentage rate is what you need to watch.

Ultimately, this is more than just saving a few pence here and there. It's about finding a long-term partner that scales with you, not one that becomes a financial drag on your growth. Once you get your head around your sales data and the fee structures out there, you can pick a processor that actually empowers your business.

Ready to turn your Telegram community into a thriving business? MyMembers offers a no-code solution that integrates seamlessly with your Stripe account, automating member management so you can focus on your content. Start monetising your community in minutes.