Why Your Subscription Business Needs More Than Just a Payment Gateway

While a standard payment gateway like PayPal or a basic card processor can collect initial payments, it's not equipped to manage the complexities of a subscription-based business. Relying on such tools forces you into manual, time-consuming tasks that hinder growth. From chasing failed payments to manually adjusting invoices for plan changes, these administrative burdens quickly become unmanageable as your subscriber base expands. This is where dedicated recurring billing software becomes essential.

These platforms are not just payment collectors; they are sophisticated engines designed to automate the entire subscriber lifecycle. They handle critical functions that basic gateways ignore, such as automated dunning management to recover lost revenue, complex proration calculations for upgrades or downgrades, and ensuring compliance with revenue recognition standards. They provide your members with self-service portals to manage their own subscriptions, reducing your support workload and improving the customer experience.

This article moves beyond generic feature lists to provide a practical, in-depth analysis of the top 12 recurring billing software solutions available to UK businesses. We will explore specific use cases, implementation challenges, and the honest limitations of each platform. You will gain the insights needed to select the right tool to automate your operations, reduce involuntary churn, and successfully scale your membership or subscription service.

1. MyMembers: The No-Code Choice for Telegram Creators

MyMembers carves out a specific niche within the recurring billing software landscape by focusing exclusively on creators monetising Telegram communities. Its core strength lies in its profound simplicity and rapid deployment. Unlike more generalised platforms, it’s designed for users who prioritise speed over an exhaustive feature set. A creator can link their Stripe account and generate a branded payment landing page in under ten minutes, a task that often requires significant configuration on other systems.

The platform's value extends beyond simple payment collection; it provides an automated member management solution. When a user subscribes, MyMembers automatically sends a Telegram invite link. More importantly, it revokes channel access if a payment fails or a subscription is cancelled, directly addressing a critical administrative pain point for community managers. This automation makes it a powerful, hands-off tool for maintaining a paid community. For creators looking to deepen their channel strategy, it's also worth exploring tools to master Telegram analytics to complement the financial management MyMembers provides. This combination of seamless billing and audience insight can be particularly effective.

2. Chargebee: The Enterprise-Grade Solution for SaaS Growth

Chargebee positions itself as a comprehensive recurring billing software designed for scaling SaaS and subscription-based e-commerce businesses. Its primary advantage lies in its capacity to manage complexity. Where simpler tools focus on basic payment collection, Chargebee excels at handling intricate billing logic, such as usage-based billing, tiered pricing, and add-ons. It is engineered for businesses that are expanding globally, offering robust support for multiple currencies, global tax compliance, and revenue recognition that adheres to ASC 606 and IFRS 15 standards.

b7871a9c-4507-40b0-bcf5-907ea626c3a1.jpg

The platform's power comes with a steeper learning curve and a higher price point, making it less suitable for early-stage startups or individual creators. However, for a growing company, its automated dunning management system is a significant asset, actively recovering revenue that would otherwise be lost to failed payments. The advanced analytics also provide deep insights into key metrics like Monthly Recurring Revenue (MRR), churn, and customer lifetime value. For businesses ready to optimise their monetisation strategy, exploring different subscription pricing examples can help maximise the powerful models Chargebee supports.

3. Recurly: The Enterprise-Grade Solution for Global Scale

Recurly positions itself as a robust, enterprise-level recurring billing software designed for businesses that require sophisticated subscription logic and global operational capacity. Its primary strength lies in its ability to handle complexity, from intricate pricing models to international compliance. Where simpler tools focus on straightforward monthly plans, Recurly excels at managing usage-based billing, tiered pricing, and complex promotional schemes. This makes it an ideal choice for established SaaS companies or large-scale digital publishers whose revenue models extend beyond a single, flat fee.

896b0a11-1a13-45c1-a0c9-190fba0c1dbc.jpg

The platform's developer-friendly API is a significant asset, allowing for deep customisation and integration into existing tech stacks. This is particularly valuable for businesses needing to connect their billing system with CRMs, accounting software, and proprietary applications. Furthermore, its advanced features, such as automated tax collection in over 47 countries and support for 20+ languages, directly address the challenges of international expansion. However, this power comes at a cost; its pricing structure and the technical expertise required for advanced features can be prohibitive for small businesses or solo creators just starting their subscription journey.

4. Zoho Billing: The Integrated Ecosystem Solution

Zoho Billing stands out as a formidable piece of recurring billing software, primarily due to its native integration within the wider Zoho ecosystem. For businesses already using Zoho CRM, Books, or other applications, adopting Zoho Billing is a logical and powerful step. It removes the friction of third-party integrations, allowing customer data, invoicing, and subscription details to flow seamlessly between platforms. This unified approach simplifies everything from sales handoffs to financial reconciliation, creating a single source of truth for the entire customer lifecycle.

73823f3f-2e12-466a-8fd7-36720bdf16e2.jpg

The platform’s strength is particularly evident in its automated dunning management and usage-based billing capabilities. Where other tools might offer basic payment reminders, Zoho automates a sophisticated sequence of communications for failed payments, significantly improving revenue recovery without manual intervention. For businesses with variable consumption models, like SaaS companies or digital service providers, its ability to track and bill based on usage is a core advantage. While customisation can feel restrictive compared to more developer-focused platforms, its out-of-the-box functionality and cost-effectiveness make it an excellent choice for small to medium-sized businesses seeking an all-in-one solution.

5. Stripe Billing: The Developer-First Powerhouse

Stripe Billing is less a single product and more a foundational layer for building sophisticated recurring revenue models. Its API-first design makes it the go-to choice for businesses that require deep customisation and have access to development resources. Unlike out-of-the-box solutions, Stripe Billing provides the building blocks for developers to create complex billing logic, from tiered pricing and metered usage to per-seat licensing. It’s ideal for SaaS companies and platforms that need a system that can evolve with their product offerings.

edacd924-e74b-4b82-9322-c4c5a67ea800.jpg

The platform's strength is its seamless integration into the broader Stripe ecosystem, including Payments, Tax, and Radar for fraud prevention. This creates a unified financial infrastructure. Its robust dunning management automatically handles failed payments with customisable retry schedules and email notifications, a critical function for reducing churn. While powerful, the trade-off is complexity; implementation is not a simple sign-up process but a development project. For those exploring what models are possible with such a tool, it’s useful to see some real-world subscription business model examples to understand its full potential.

6. GoCardless: The Bank-to-Bank Payments Specialist

GoCardless distinguishes itself from card-focused platforms by specialising in bank-to-bank payments, particularly Direct Debit. This makes it a compelling piece of recurring billing software for businesses in the UK and Europe where Direct Debit is a trusted, low-cost payment method. It’s ideal for service-based businesses like digital agencies, fitness clubs, or childcare providers that bill clients on a fixed schedule. The platform’s primary function is to automate the entire Direct Debit collection process, from customer authorisation to payment collection and reconciliation, significantly reducing administrative overhead.

24fbb3e2-9121-423d-95b7-f7e4f50cf2be.jpg

The real power of GoCardless lies in its payment optimisation features. Its Success+ tool intelligently retries failed payments on the date a customer is most likely to have funds, a data-driven approach that can dramatically reduce churn caused by simple payment failures. While its strength is Direct Debit, this is also its main limitation; businesses that rely heavily on credit and debit card transactions might find it less suitable as a standalone solution. However, for UK and European businesses aiming to minimise transaction fees and stabilise cash flow through reliable bank payments, GoCardless offers a focused, cost-effective, and powerful system.

7. Xero: Integrated Accounting and Recurring Invoices

While primarily known as a comprehensive accounting platform, Xero offers robust recurring billing software capabilities that are deeply integrated into its financial management ecosystem. It is an ideal solution for small businesses, agencies, and freelancers who need to manage their entire financial picture, from invoicing to reconciliation, in one place. Instead of a standalone billing system, Xero treats recurring invoices as a core accounting function, allowing users to set up templates that automatically generate and send invoices to clients on a custom schedule. This approach streamlines cash flow management by tying revenue directly to bookkeeping records without manual data entry.

60cef961-e04d-4651-84ca-3be209b8d578.jpg

The platform’s strength is its seamless connection to payment gateways like Stripe and GoCardless, enabling businesses to offer clients easy online payment options directly from the invoice. Automated reminders for overdue payments help reduce administrative burden and improve collection times. However, because Xero is an accounting-first platform, its recurring billing features are less sophisticated than dedicated subscription management tools. It lacks advanced dunning management or complex subscription logic like metered usage. It is best suited for businesses with straightforward, fixed-fee subscription models or retainers who prioritise unified accounting and billing over specialised subscription analytics.

8. QuickBooks: Accounting-Centric Recurring Billing

QuickBooks approaches recurring billing from an accounting-first perspective, making it a powerful choice for UK freelancers and small businesses that need to integrate subscription payments directly into their financial workflows. Rather than being a standalone payment gateway, its strength lies in its ability to automate invoicing and reconcile payments against bank transactions, all within a single system. This is particularly useful for service-based businesses, like digital coaches or consultancies, who bill clients on a fixed retainer. The setup involves creating a recurring invoice template, setting the frequency, and letting the system automatically dispatch it to clients.

a620e042-a21d-494d-a475-3c4e6b293612.jpg

The platform’s integrated features offer a distinct advantage. Its advanced VAT calculator and robust reporting are tailored for UK compliance, simplifying tax obligations. However, QuickBooks functions more as an automated invoicing tool than a comprehensive subscription management platform. It excels at sending bills and tracking payments but lacks the sophisticated dunning management or automated access control seen in more specialised recurring billing software. Its value proposition is clear: if your primary need is to streamline billing within a full-featured accounting package, QuickBooks is an exceptionally strong and well-supported option, though advanced features are often locked behind higher-tier plans.

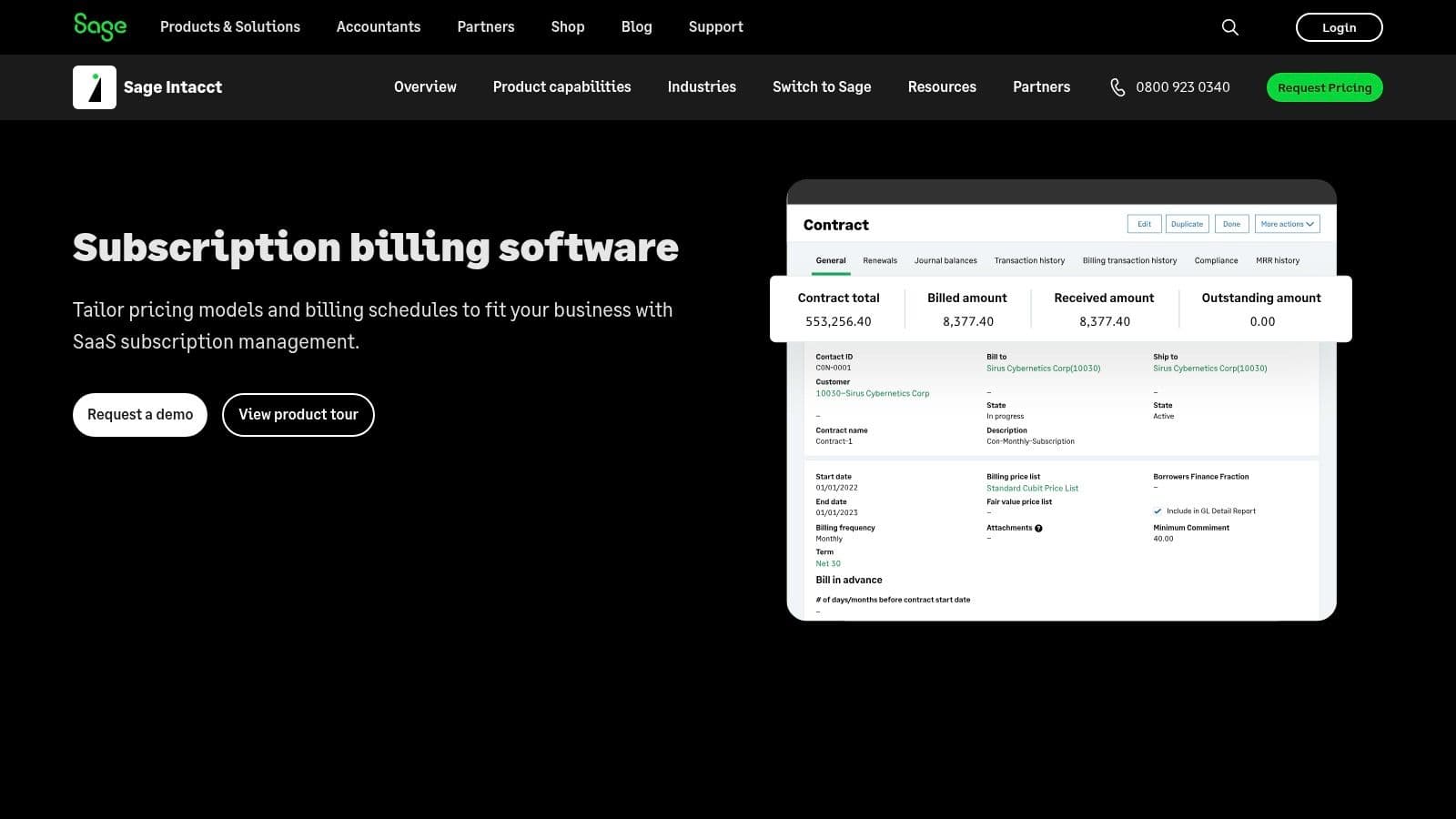

9. Sage Intacct: The Compliance-Focused Financial Hub

Sage Intacct positions itself as more than just a recurring billing software; it's a comprehensive cloud financial management platform. Its strength lies in handling complex billing scenarios for established businesses that prioritise compliance and scalability over simple payment processing. For organisations dealing with varied contract terms, usage-based fees, and tiered pricing, Sage Intacct provides a robust framework. It automates the entire contract-to-cash lifecycle, from renewal management to revenue recognition, making it a powerful tool for finance departments.

a6c4ba1e-f423-4469-bc66-e3d49263ce0f.jpg

The platform’s standout feature is its rigorous adherence to accounting standards like IFRS 15, automating complex revenue recognition that would otherwise require significant manual work. Its native integration with Salesforce allows for a seamless flow of data between sales and finance, ensuring billing is always aligned with the latest contract details. However, this level of sophistication comes at a cost. The system can be overly complex for small businesses or solo creators, and its pricing is not public, suggesting a higher entry point. It is best suited for mid-sized to enterprise-level companies where financial compliance and automation are mission-critical.

10. FreeAgent: UK-Focused Accounting and Billing

FreeAgent stands out by integrating recurring billing software directly into a comprehensive accounting platform designed specifically for UK freelancers and small businesses. Its primary advantage is not just automating invoices but ensuring that the entire financial workflow, from estimate to payment to tax filing, is seamless and compliant with HMRC regulations. Users can set up recurring invoice profiles for clients, which are automatically generated and sent on a schedule, significantly reducing administrative overhead for retainer-based work or ongoing service subscriptions.

ece07e0e-1ee1-4996-ba16-cea2495c0a07.jpg

The platform’s real strength lies in its context-aware functionality. For example, once an invoice is paid, FreeAgent automatically categorises the income and updates your real-time tax forecasts for Self-Assessment, VAT, and Corporation Tax. This makes it an invaluable tool for a UK-based creator or small business owner who needs to manage subscriptions while also keeping a firm grip on their tax obligations. While its feature set is robust for its target market, businesses operating outside the UK will find its region-specific focus, particularly the deep HMRC integration, a significant limitation compared to more globally-oriented platforms.

11. Invoicera: Customisable Invoicing for Global Business

Invoicera positions itself as a robust recurring billing software for service-based businesses that need deep invoice customisation and global capabilities. Its primary strength is not just automating billing cycles, but allowing companies to tailor every aspect of their invoices to match specific client agreements or branding requirements. This goes beyond simple logo placement, enabling unique templates for different services or client tiers. This level of control is particularly valuable for agencies, consultancies, or B2B service providers who manage complex, non-uniform billing arrangements with an international client base.

e6dabf22-e4e0-4498-b470-8ae6f68d3752.jpg

The platform's multilingual and multicurrency support is a significant differentiator, making it a strong contender for businesses operating across borders. It simplifies the process of sending professional, legally compliant invoices to clients in their local language and currency. However, it's important to recognise that Invoicera is a specialised invoicing tool, not a full accounting suite. It excels at getting you paid but lacks features like automated sales tax calculation, meaning you'll need to integrate it with dedicated accounting software for a complete financial overview. For businesses prioritising invoice flexibility over all-in-one bookkeeping, Invoicera offers a powerful, focused solution.

12. Zuora: The Enterprise-Grade Subscription Economy Engine

Zuora positions itself as an enterprise-level platform for managing the entire subscription lifecycle, moving far beyond simple payment processing. It’s designed for large, complex organisations that need to orchestrate intricate billing models, manage revenue recognition compliance, and analyse detailed subscription metrics. Unlike simpler tools, Zuora is built to handle usage-based pricing, tiered plans, and promotional schemes on a global scale. It acts as a central hub, integrating with ERPs like NetSuite and CRMs like Salesforce to create a unified system for finance, sales, and operations teams.

a5495d34-39df-40c8-bebc-6afc3ae7ed76.jpg

The platform’s power lies in its robust architecture. Its strength in revenue recognition is a key differentiator, helping businesses comply with complex accounting standards like ASC 606 and IFRS 15 automatically. This makes it an essential piece of recurring billing software for public companies or those preparing for an IPO. However, this level of sophistication comes with a significant implementation cost and complexity. Pricing is not public, and setup typically requires dedicated project management, making it unsuitable for small businesses or creators who need a quick, straightforward solution. Zuora is the right choice for established enterprises building a long-term, scalable subscription business.

Recurring Billing Software Comparison Matrix

| Platform | Core Features / Automation ✨ | User Experience / Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 | Price Points 💰 |

|---|---|---|---|---|---|---|

| 🏆 MyMembers | No-code setup, Stripe integration, automated member mgmt | Intuitive, fast setup, real-time revenue analytics | Streamlined Telegram monetization, promo offers | Creators, coaches, influencers | Tailored for Telegram, customized landing pages | Not explicitly stated, inquire |

| Chargebee | Subscription billing, revenue recognition, global tax mgmt | Robust dashboards, ASC 606/IFRS compliant | Scalable SaaS billing, strong compliance | Growing SaaS & digital enterprises | Comprehensive billing models, advanced analytics | Flexible, can be costly |

| Recurly | Automated invoicing, multi-language & tax support | Developer-friendly, advanced analytics | Flexible subscription management | Medium-large businesses, ecommerce | Wide international support, customizable templates | Flexible, higher entry price |

| Zoho Billing | Recurring invoices, usage-based billing, dunning mgmt | User-friendly, seamless Zoho integration | Cost-effective for SMBs | Small-medium businesses | Zoho ecosystem integration | Affordable |

| Stripe Billing | API-first, metered billing, multi-currency, dunning | Highly customizable, scalable | Global payment support, developer focused | Tech-savvy businesses, global scale | Extensive payment & currency options | Transaction fees + add-ons |

| GoCardless | Direct Debit automation, international payments | Easy integration, UK/Europe focused | Cost-effective bank payments | UK/EU businesses, enterprises | Strong focus on Direct Debit, fraud protection | Competitive |

| Xero | Custom invoices, automated reminders, recurring billing | User-friendly, comprehensive reporting | Accounting & billing combined | Small businesses, accountants | Integration with Stripe/GoCardless | Moderate pricing |

| QuickBooks | Automated invoices, VAT calculator, bank reconciliation | Easy setup, strong reporting | Integrated accounting for small businesses | Freelancers, small businesses | UK VAT support | Subscription-based |

| Sage Intacct | Flexible pricing, auto-renewals, revenue recognition | Scalable, comprehensive automation | Enterprise-grade financial mgmt | Growing enterprises | Salesforce integration, 300+ billing scenarios | Not publicly disclosed |

| FreeAgent | Recurring billing, expense tracking, HMRC compliance | Intuitive, cloud-based | Dedicated UK compliance | UK freelancers, SMBs | Mobile apps, HMRC tools | Subscription-based |

| Invoicera | Automated billing, multilingual, client portal | Highly customizable invoices | Extensive billing features | All business sizes | Unlimited invoices across plans | Varies, plans available |

| Zuora | Recurring billing, revenue recognition, subscription metrics | Enterprise-grade, strong integrations | Large-scale subscription management | Large enterprises | Broad platform integration | Not publicly disclosed |

Choosing Your Platform: Matching Features to Your Business Model

Navigating the landscape of recurring billing software can feel overwhelming, but making an informed choice is about aligning a platform's strengths with your specific business needs. We've explored a wide spectrum of tools, from dedicated creator platforms to robust enterprise financial systems. The key takeaway is that the "best" software is entirely relative to your operational stage, technical expertise, and future growth ambitions.

Instead of getting lost in feature-by-feature comparisons, a more effective approach is to first categorise your own business requirements. This self-assessment is the crucial first step in filtering the extensive list of options down to a manageable shortlist.

A Framework for Your Decision

To simplify your selection process, consider where your business fits within these distinct archetypes we've analysed:

- For Creators & Niche Communities: If you're a Telegram channel owner, digital coach, or content creator, your primary need is simplicity, speed, and direct integration with your community platform. A solution like MyMembers is purpose-built for this, prioritising ease of use and rapid setup over complex financial customisation.

- For Accounting-First Operations: Small businesses that already rely on accounting software like Xero, QuickBooks, or FreeAgent for their core financials should first explore the recurring billing modules offered by these platforms. This approach centralises your financial data, simplifies reconciliation, and leverages your existing software investment.

- For Scaling SaaS & Subscription Businesses: As your business model grows in complexity with tiered pricing, add-ons, and a focus on metrics like churn and LTV, specialised platforms become essential. Chargebee and Recurly excel here, offering powerful dunning management, analytics, and integrations designed for high-growth subscription models. Stripe Billing offers a developer-centric, highly customisable alternative within this category.

- For Complex Enterprise Needs: Large organisations with sophisticated revenue recognition requirements, multi-entity management, and the need for a full quote-to-cash system will find their match in enterprise-grade solutions. Sage Intacct and Zuora are designed to handle this level of financial complexity, though they require significant investment in implementation and resources.

Key Considerations Before You Commit

Before finalising your decision on a recurring billing software, take a moment to evaluate these critical factors:

- Implementation Overhead: How much technical know-how is required to get started? A platform like GoCardless or MyMembers can be operational in hours, whereas Zuora or a custom Stripe implementation could take weeks or months. Be realistic about the time and resources you can dedicate.

- Customer Journey Integration: Your billing system is a critical touchpoint in the customer experience. It must seamlessly integrate with your marketing, sales, and support processes. Consider how the platform supports the entire customer lifecycle, as detailed in a comprehensive guide to ecommerce sales funnels, to ensure a smooth and professional experience from sign-up to renewal.

- Scalability and Future Costs: The platform that fits your budget today might become prohibitively expensive as you grow. Analyse the pricing tiers and be mindful of revenue-sharing models. Choose a partner that can support your projected growth without forcing a costly migration down the line.

Ultimately, selecting your recurring billing software is a strategic decision that directly impacts your revenue stability and operational efficiency. By carefully matching your unique business model to the right category of tool, you can implement a system that not only automates payments but also empowers your growth.

Ready to manage your community subscriptions with a tool built specifically for creators? MyMembers offers the simplest way to monetise your Telegram groups and channels, handling recurring billing so you can focus on your members. Start your free trial today and see how easy managing a paid community can be.