Why Your PayPal Recurring Payments Need Immediate Attention

8d05a907-b582-4cac-b7c9-f35856fae542.jpg

Let's be honest, we've all been there. Forgotten subscriptions can be a real drain on your PayPal account. I've chatted with loads of people in the UK who've discovered they were paying for things they hadn't used in ages – sometimes years! I remember one person finding they were being charged £127 every month for apps they’d completely forgotten about.

PayPal makes paying for things so easy, it's almost too easy. While convenient, those seamless payments can lead to a slow, steady leak in your finances. And it's not just about saving a few pounds. It’s about knowing where your money's going and being in control.

The rise of the subscription economy definitely isn't helping. Think about how many services you subscribe to – it’s probably more than you realize. The recurring payments market, which includes platforms like PayPal, is expected to hit $182.94 billion globally by 2025. That's a 9.7% annual growth rate! You can see the research on this growth here. In the UK, we’re increasingly comfortable with automated transactions, making it even more important to know how to stop recurring payments on PayPal.

To make things worse, some companies make it incredibly difficult to cancel. They bury the cancellation button deep within their sites or apps. Inertia is their best friend; the longer you subscribe, the more they profit. That's why it’s crucial to understand how to navigate these systems and protect your money.

In the next few sections, I'll show you exactly how to spot these hidden costs and take back control of your PayPal subscriptions. We'll even cover what to do if a company makes cancellation a real pain.

Decoding PayPal's Recurring Payment Maze

eb011f2a-3640-435a-958d-f2462896f9b3.jpg

So, you're looking to ditch a recurring payment in PayPal? Before you go on a clicking spree inside your account, let's talk about the different kinds of automatic payments PayPal handles. It's not always straightforward, and knowing the difference can save you a lot of frustration.

PayPal essentially juggles three types of recurring charges. First, there are pre-authorized payments. This is where you've given a company the green light to bill you regularly. Think of it like an open tab.

Then you have billing agreements, a slightly more formal setup with merchants. These often involve specific terms and conditions.

Finally, we've got the familiar subscription services, those recurring payments for things like Netflix or Spotify.

The tricky part? PayPal’s dashboard doesn’t always make these distinctions crystal clear. I've seen people hunting high and low for a gym membership they thought was a subscription, only to find it lurking under pre-authorized payments. Trust me, this matters. The steps to cancel each type are different.

This is especially true in the UK, where PayPal is king. A whopping 69% of digital payment users here rely on PayPal. That's a lot of us navigating this recurring payment maze! Want to dive into the stats? Check them out here.

Knowing what you’re cancelling is half the battle. Some of these payments require a bit more finesse than just hitting "cancel." Let's untangle these payment types so you can cancel that unwanted charge with confidence.

Uncovering Your Hidden Financial Commitments

31f79eb3-7fc8-4cf5-a78e-77059854be8d.jpg

Let's be honest, navigating your PayPal account can sometimes feel like an archaeological dig. You might be surprised (or shocked!) by the sheer number of recurring payments lurking in the digital undergrowth. It's a common issue – most people have no idea how many subscriptions they've actually authorized. PayPal, unfortunately, doesn't exactly make it easy to unearth these hidden financial commitments.

It's a bit like a financial advisor auditing a client's portfolio; you've got to be systematic. The information isn't all in one convenient spot, so we'll explore a few key areas.

Where to Look For Recurring Payments

First, head to the Automatic Payments section. This is the usual hangout for your regular subscriptions, like streaming services or monthly software fees. Think of it as your first layer of excavation.

But don't stop digging just yet. Preapproved Payments is the next site to investigate. These are the agreements you've made with merchants, giving them permission to bill you – things like online stores or donation platforms. It's incredibly easy to forget about these, especially if they only bill you occasionally.

Lastly, and this might seem a bit tedious, dive into your transaction history. It's crucial for spotting those sneaky recurring charges that might have slipped through the cracks. Maybe you see a payment for the same amount popping up every month, but it's not showing up as a formal subscription. That’s a red flag worth exploring.

In my experience helping people do this, I've seen some real surprises unearthed. Forgotten free trials that morphed into paid subscriptions, annual fees that were mistaken for monthly ones, and even payments to companies people simply didn't recognize. Deciphering cryptic merchant names is a skill in itself! Ever seen a charge from a company with a string of random letters and numbers? I'll show you how to figure out what it actually is later.

To help you understand the different kinds of recurring payments you'll encounter in your PayPal account, I’ve put together this handy table:

Types of PayPal Recurring Payments

| Payment Type | How It Appears | Cancellation Method | Common Examples |

|---|---|---|---|

| Subscriptions | Listed in Automatic Payments | Cancel directly from the Automatic Payments section | Streaming services (Netflix), Software subscriptions (Adobe Creative Cloud), Magazine subscriptions |

| Pre-approved Payments | Listed in Preapproved Payments | Cancel through the Preapproved Payments section, sometimes requires contacting the merchant directly. | Online retailers (Amazon), Charitable donations, Bill payments |

| Recurring Charges (not formal subscriptions) | Appear in your Transaction History as repeat transactions. | Often requires contacting the merchant directly. | Gym memberships, Utility bills, Online gaming subscriptions |

This whole process can be a real eye-opener, but trust me, it’s the first step to taking back control of your finances. Knowing where your money is going is empowering!

Decoding Mystery Merchants

Coming up, we'll tackle those confusing merchant names. I'll give you some insider tips on how to decode those cryptic charges and finally understand where your money’s going. Stay tuned!

The Bulletproof Method To Stop Recurring Payment On PayPal

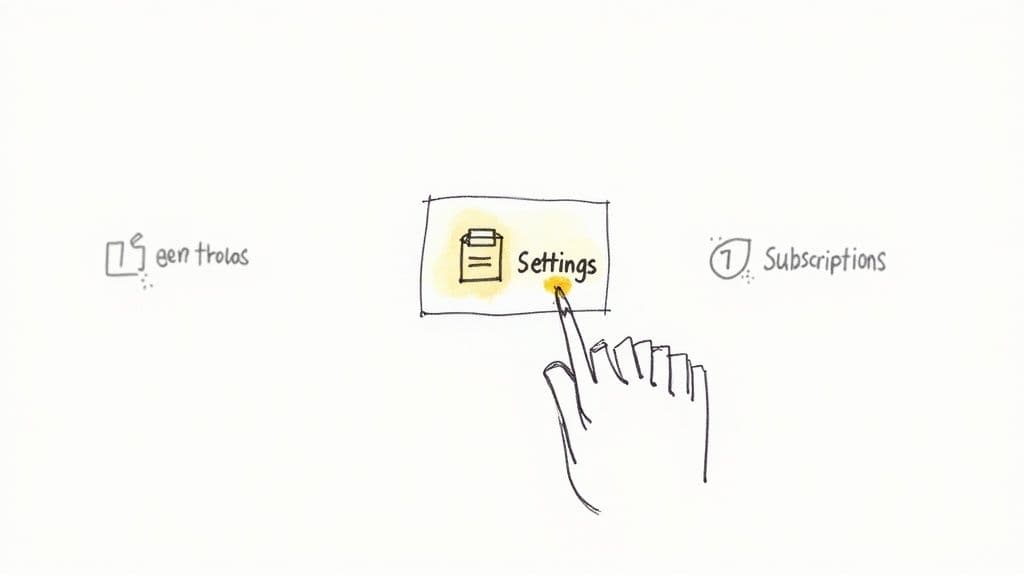

Okay, so you want to cancel a recurring PayPal payment? I've helped tons of people with this, and let me tell you, PayPal's interface can be a moving target. But I've got a method that works like a charm, no matter how much they change things. Login first. And pay attention – there’s a big difference between using the mobile app and your desktop. What you can actually cancel sometimes depends on how you're logged in. Usually, desktop gives you more control.

Now, ideally, you'll find that little 'Settings' cog, click through to 'Payments', and then find 'Manage automatic payments'. That's the express route. But sometimes, PayPal hides things. So, plan B: cancelling from your activity feed. This is your lifesaver when the recurring payment is playing hide-and-seek. We’ll even cover those annoying ‘greyed out’ payments that usually mean you'll have to contact the merchant directly. Fun times, right?

4f0eb61f-13ca-4314-bbb1-b8502087c4ac.jpg

This screenshot shows the account selection page – and it’s a good reminder to double-check you're in the right account before you start clicking. Trust me, accidentally cancelling a subscription on the wrong profile is not a mistake you want to make. Been there, done that, got the t-shirt.

Side note: If you use PayPal for business stuff and are looking for ways to save a few bucks, check out TikTok Shop promo codes. Never hurts to look for a deal, right?

Confirming Your Cancellation

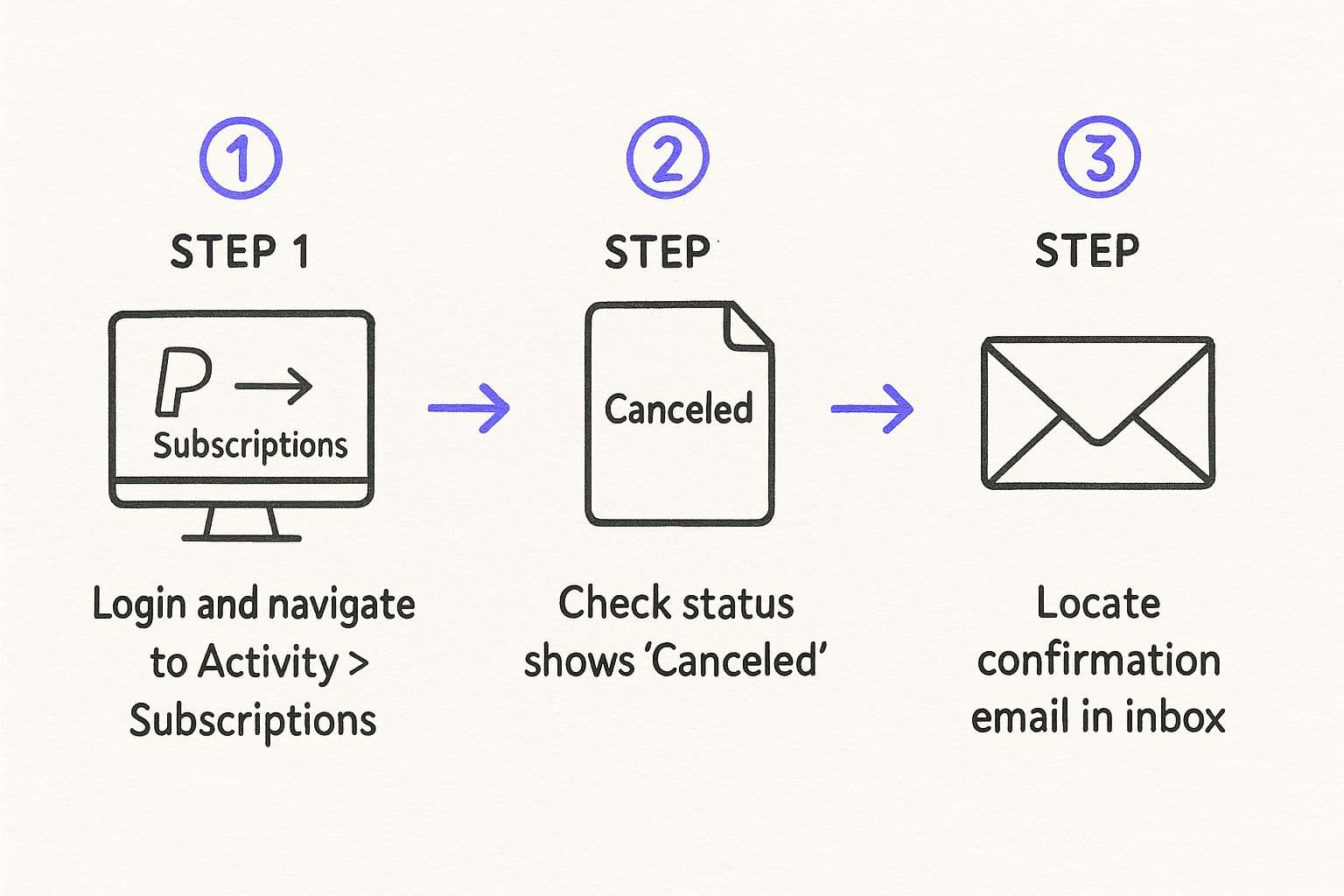

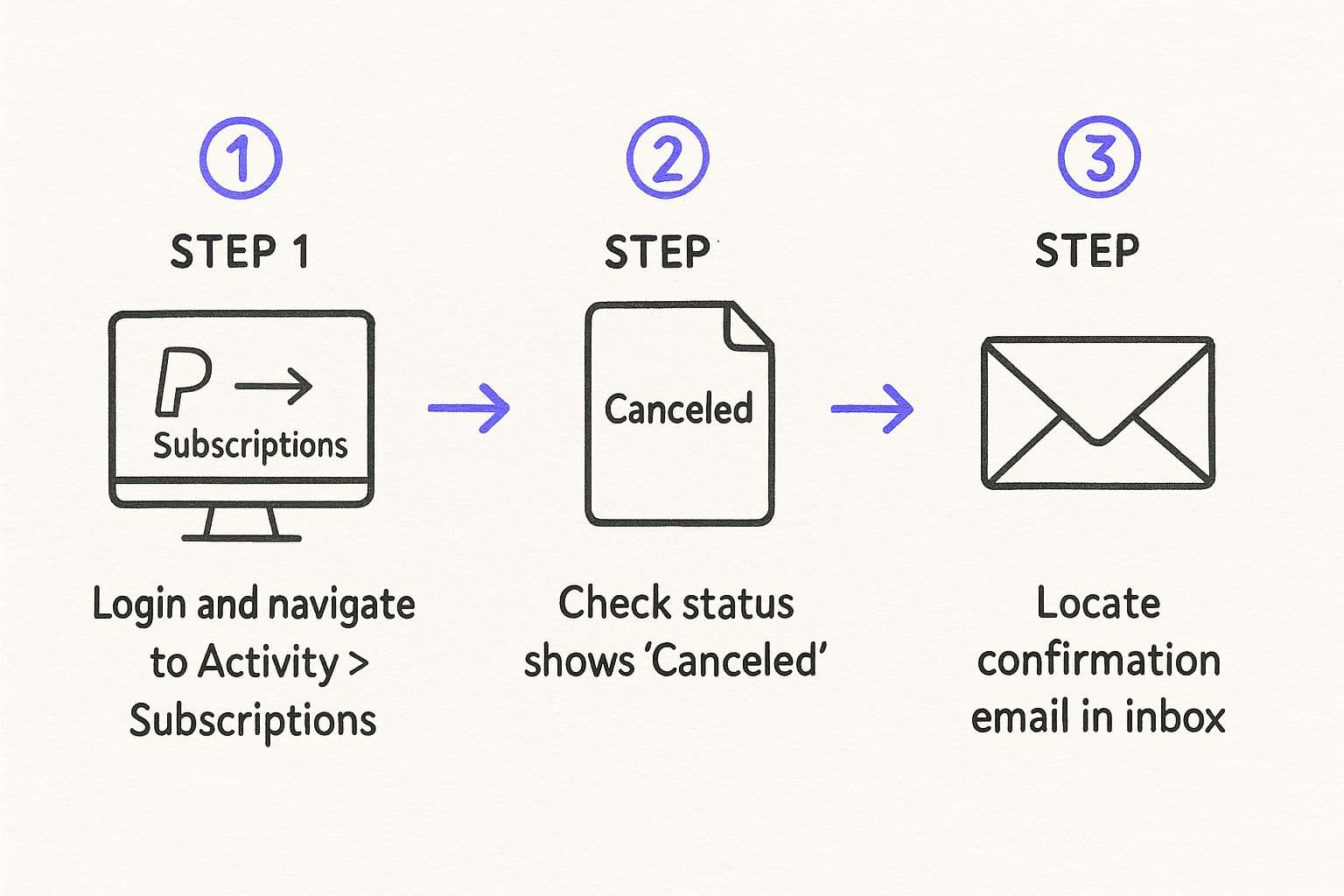

Cancellations can take 24-48 hours to go through, so don’t freak out if the charge doesn't vanish instantly. But always, always confirm. Here's how:

- Check your activity feed for that sweet, sweet 'Cancelled' status.

- Look out for a confirmation email. PayPal usually sends one, just to be sure.

This infographic sums it up. Three easy steps to confirm that recurring payment is actually stopped. This isn't just about saving money – it's about taking control of your finances and only paying for what you use. In the next section, we’ll tackle those stubborn payments that just won’t quit.

4f0eb61f-13ca-4314-bbb1-b8502087c4ac.jpg

Tackling The Payments That Won't Quit

embed

We've all been there. You hit "cancel" on a recurring payment, thinking you're finally free, but then… bam. The phantom payment rises again. It’s like a digital zombie you just can't kill. I’ve dealt with these frustrating scenarios more times than I care to remember, so trust me, I get it. Sometimes cancelling a subscription through PayPal isn't enough to stop a merchant's billing attempts.

So, what happens when cancelling within PayPal doesn't quite translate to the merchant actually stopping their charges? You’re left battling recurring payments that stay stubbornly "active", subscriptions that force you to jump through hoops and contact the merchant directly, or even worse, companies claiming they never received your cancellation request.

Don't panic. You're not alone, and there are ways to fight back.

What To Do When Cancelling Doesn't Work

First, take a deep breath. There are options. We’ll explore when to use PayPal's dispute resolution process, how to effectively use your UK consumer rights, and when it might be necessary to contact your bank. I'll even share some of the email templates and scripts that I've personally used to get results from unresponsive merchants. Escalation, my friends, can be a beautiful thing.

For those looking for broader help with subscription or payment management, the Postpaddle Homepage might offer some helpful tools. Navigating these issues can be a bit like wading through treacle with the ever-shifting world of digital payments. Did you know that in the UK, roughly 69% of digital payment users still use PayPal as of 2023? But its use for online shopping has gone up and down, so staying informed about these trends is key. For a deeper dive into how PayPal's use in the UK has changed, check out the stats here. We'll also dig into PayPal’s buyer protection and what documentation you absolutely need to have if things go sideways. Knowing your rights and how to enforce them is half the battle.

Building Your Subscription Defense System

So, you've finally wrestled those rogue recurring payments into submission. High five! Now, let’s talk about how to avoid this whole subscription showdown ever happening again. Forget complicated budgeting apps or spreadsheet nightmares. I'm sharing the real-world strategies that actually work for busy people. These are the tricks I use myself to keep my subscriptions in check without needing to constantly police them.

Smart Strategies for Taming Your Subscriptions

One of the best things I've started doing is a monthly subscription audit. It's not as scary as it sounds. Just block out 15 minutes each month to go through your PayPal activity. Think of it as a financial health check-up. Trust me, this small time investment can save you a surprising amount of cash in the long run by catching those sneaky charges before they add up. If you're easily distracted while checking online, muting certain notification keywords can help you focus. Here’s a helpful guide on muting words on X (formerly Twitter).

Another common subscription trap? Free trials. We've all been there – signed up for something, then completely forgot to cancel before the trial ended. My solution? The calendar reminder. Before I start any free trial, I set a reminder on my phone for two days before it expires. This gives me enough time to actually try the service and decide if I want to keep it. It's especially useful for those tricky trials that automatically roll into paid subscriptions. You know the ones.

Your payment method matters too. For subscriptions you know you’ll stick with, using a credit card directly through the service provider might give you better purchase protection than going through PayPal. But for those short-term trials or services you're not sure about, PayPal's easy cancellation process is a godsend. Setting yourself up strategically from the start makes all the difference.

Outsmarting Sneaky Subscription Tactics

Let's be real, companies often make cancelling subscriptions unnecessarily difficult. They bury the cancellation button deep within their website or use vague language about renewal terms. If a service makes it feel like pulling teeth just to find the cancellation information before you even subscribe, imagine the headache it’ll be after. Consider that a major red flag. A service that's confident in its value won't make it a mission to unsubscribe.

Staying on top of your finances shouldn’t feel like a constant uphill battle. It’s about building sustainable habits and being aware of potential pitfalls. To help you stay organized, I've put together a handy checklist.

To help you stay organized, I've put together a handy checklist to manage your monthly subscriptions:

Monthly Subscription Management Checklist: Essential tasks to keep your recurring payments under control

| Task | Frequency | Time Required | Benefit |

|---|---|---|---|

| Review PayPal Activity | Monthly | 15 minutes | Identify unwanted charges and potential savings |

| Set Calendar Reminders for Free Trials | Before each trial starts | 1 minute | Avoid unwanted charges from forgotten trials |

| Evaluate Payment Methods | Before subscribing | 2 minutes | Optimize payment security and cancellation ease |

| Check Cancellation Policies | Before subscribing | 5 minutes | Avoid services with difficult cancellation processes |

This checklist helps you build a proactive approach to managing your subscriptions, saving you time and money. By taking a few minutes each month to review your subscriptions, you can identify potential savings and avoid unwanted charges.

Ultimately, taking control of your recurring payments is about peace of mind. By using these practical tips and creating your own "subscription defense system," you’ll be well on your way to achieving financial zen.

Your Complete Action Plan For Payment Freedom

Let's get practical. We've covered a lot, so how do you actually wrestle back control of your PayPal subscriptions? This isn't about perfection, it's about making real progress and feeling good about where your money is going. Let's start with some immediate actions you can take this afternoon to audit your PayPal recurring payments, then we’ll talk about building some longer-term habits.

Prioritize Your PayPal Audit Like a Pro

Think of this like a financial triage. What's bleeding your account the most? Here's a prioritized checklist to get you started:

- High Priority (Today): Dive into your PayPal account. Seriously, go do it right now. Head to the "Automatic Payments" and "Pre-approved Payments" sections. See anything you don't recognize or haven't used in months? Hit that cancel button like a boss.

- Medium Priority (This Week): Don’t stop there. Recurring charges love to hide in your transaction history. Take a few minutes this week and scroll back. You might be surprised by those sneaky little payments that don't show up as formal subscriptions. They add up.

- Low Priority (This Month): Now, let’s build some good habits. Schedule a 15-minute monthly subscription audit. Block it out in your calendar. This is your financial checkup – a powerful preventative measure to keep those sneaky subscriptions from creeping back in. Trust me, future you will thank you.

Managing Expectations and Making Decisions

Real talk: some cancellations take 24-48 hours to process through PayPal. So, don't panic if the charge doesn’t vanish instantly. Double-check the cancellation by looking for that "Cancelled" status in your activity feed. Keep an eye out for a confirmation email too. PayPal usually sends one just to be sure.

When deciding what stays and what goes, ask yourself two key questions: Do I actually use this service regularly? and Is it truly worth the money? If you’re hesitating, it’s probably time to say goodbye.

Troubleshooting Those Stubborn Subscriptions

What about those stubborn payments that just won’t quit? I've been there. We’ll get into troubleshooting common issues later, plus I’ll share contact info and escalation steps for when the standard approach fails. And yes, we'll cover PayPal’s buyer protection too. Don't let companies bully you into paying for services you’re not using.

By the way, if you're a creator looking to monetize your Telegram community, check out MyMembers. It’s a no-code platform that integrates with Stripe for easy payment processing and subscription management. It's worth a look if you're trying to simplify your membership admin and get back to creating awesome content.