Why Smart UK Businesses Are Switching To Recurring Payments

a3077a4d-80e8-473d-95da-86effd3664cb.jpg

Chasing late payments? It's the worst. I've seen it firsthand – the drain on time and resources. But honestly, switching to Stripe recurring payments has been a game-changer for so many UK businesses I work with. From yoga studios in Bristol to tech startups in London, having that predictable monthly revenue coming in really changes how you operate.

One of the biggest impacts? Cash flow. Forget the feast-or-famine cycle of manual invoicing. Recurring payments create this steady, reliable income stream, allowing for better financial forecasting and planning. That’s crucial in the UK's dynamic market. This predictability lets you invest confidently in growth, secure better loan terms, and ride out economic uncertainty.

Recurring revenue models also often lead to increased customer lifetime value. A subscriber paying monthly for a year generates way more revenue than a one-time purchase. This ongoing engagement builds stronger customer relationships and real brand loyalty.

Plus, automated billing drastically reduces admin. I've seen businesses cut their admin time by a whopping 70%, freeing them up to focus on product development and customer service. This efficiency is a big reason why recurring payments are taking off so quickly across the UK.

The UK Digital Payments Boom

Speaking of growth, the UK digital payments market is exploding. It's projected to hit $447.9 billion by 2025. That shows how quickly things are moving toward digital transactions. Discover more insights on this trend. This creates a huge opportunity for businesses using Stripe recurring payments.

Setting Up Your Stripe Account The Right Way From Day One

So many businesses trip up here – they rush through setting up their Stripe account and end up paying for it later. Think of your Stripe configuration as the foundation of your house (or, you know, your recurring payment system). A solid foundation prevents billing nightmares down the road. One major perk of recurring revenue is that it helps reduce churn, which is huge for your bottom line. For SaaS businesses especially, reducing churn directly impacts revenue.

Essential Settings to Configure From the Start

First up: webhooks. These little guys act like messengers, telling your system what's happening over in Stripe-land. Things like successful payments or failed renewals. Trust me, a misconfigured webhook can lead to missed payments and some very unhappy customers. I've seen it firsthand, and it's not pretty. Test them thoroughly in test mode before you go live.

Next, make sure your UK VAT settings are dialed in. Getting this right from the start saves you a world of accounting pain later. Stripe makes this fairly painless, but double-checking is key. Future you will thank you.

Finally, figure out your currency handling strategy. Offering multiple currencies can be a great move for your customers, but make sure your system can actually handle the conversions and any associated fees. Especially crucial for UK businesses selling internationally. A solid currency strategy from the get-go simplifies everything – from pricing to reporting.

Choosing the Right Stripe Billing Product

Stripe has a whole suite of billing products, and understanding the differences is crucial. For straightforward subscriptions, the standard Subscriptions API is often the perfect fit. But for more complex setups, like tiered memberships or usage-based billing, Stripe Billing offers the flexibility you'll need. Picking the right product up front prevents a painful migration later on, which can be a massive undertaking. Spend the time now to avoid rebuilding later.

UK Account Verification: A Must-Do

For UK businesses, verifying your Stripe account is non-negotiable. This means providing all the necessary details about your business and its beneficial owners. It's not just a formality – it's crucial for keeping things running smoothly. Verification prevents payout delays and ensures you're playing by the UK's rules. Don't procrastinate on this one. Get it done early and avoid any potential hiccups.

Designing Pricing That Converts And Systems Can Handle

2b029f5b-d8f5-4308-b034-50a731bb0676.jpg

Pricing your membership service right? It’s not about luck. It’s about finding that sweet spot between what your members will happily pay and what your systems can realistically handle. I’ve seen UK businesses absolutely nail this, and I’ve seen others… well, not so much. Let’s dive into what actually works.

Real-World Pricing Wins

I worked with a marketing agency in Cardiff that's killing it with tiered retainer pricing. They offer three packages – essential, premium, and enterprise – each with increasing levels of service and support. This gives clients choices and lets the agency attract businesses with different budgets. Smart, right?

Then there's this fitness app in Edinburgh. They use Stripe recurring payments to manage tiered memberships based on access levels. Basic members get online workouts, while premium members unlock personalized coaching and exclusive content. Tiered pricing through Stripe helps them scale revenue smoothly. It's all about that predictable growth.

When Simplicity Trumps Complexity

But here’s the thing: not every pricing model works for everyone. A London-based productivity tool started with usage-based billing. Sounded good on paper, but customers found it confusing and unpredictable. They simplified to a flat monthly rate and saw conversions jump. Lesson learned: understand your customer.

The Psychology of Pricing

Psychology plays a huge role. Presenting a price of £29/month often feels more digestible than £290/year, even if it’s roughly the same cost. And managing free trials? Tricky. MyMembers.io can automate trial periods and smoothly transition users to paid plans, minimizing billing headaches. Check out their resources on membership growth strategies – it's a goldmine.

To help illustrate some successful models, I've put together this table:

Proven UK Subscription Pricing Models That Actually Work

Real-world comparison of pricing structures used by successful UK businesses, showing conversion rates and implementation complexity

The table highlights how different pricing models can be tailored to specific business types. While tiered models offer flexibility and scalability, a flat rate can significantly simplify the user experience, leading to higher conversions. Hybrid models cater to specialized services, offering a balance between fixed income and usage-based charges.

Building a Future-Proof Pricing Strategy

From basic monthly subscriptions to more complex hybrid models (combining fixed fees with usage charges), Stripe offers the flexibility you need. Think long-term. Build a pricing structure that can adapt as your business grows. Don't get locked into something you can't change later.

Creating Customer Experiences That Keep People Subscribed

embed

Getting your Stripe recurring payments humming is a great first step. But the real secret sauce? Building a customer experience that keeps those subscriptions flowing month after month. I've seen it firsthand with UK businesses boasting 95%+ retention rates: they obsess over every part of the customer journey. From the moment someone signs up, to renewals years later, every touchpoint matters.

One seriously powerful tool in your arsenal? Stripe's customer portal. It lets your subscribers manage their own billing, update payment methods, and even download invoices without ever needing to bother your support team. Think about the time saved – for them and you. Fewer support tickets means more time focused on growth.

Speaking of pricing, when you're designing models for recurring payments, think about offering different tiers. Check out Whisperchat's pricing plans as a good example. A flexible approach can do wonders for your conversions.

Automating Emails That Actually Help

Email automation is your secret weapon, right? Keeps customers informed and engaged. But here's the catch: it's got to be done right. No one wants spam. Craft clear, concise billing notifications that people actually appreciate.

And ditch those pushy renewal reminders. Instead, frame them as helpful nudges. Remind customers of the value they're getting. I worked with a software company in London that saw a 20% jump in renewals just by tweaking their reminder emails. They started highlighting the specific features each customer used most – a subtle reminder of the value they were already getting. Smart, huh? Looking for more communication tips? Check out this guide on using Telegram for business.

Transparency and Flexibility Are Key

The most successful UK businesses I've worked with? They're all about billing transparency. They clearly communicate pricing, proactively explain any upcoming changes, and offer flexible subscription options. It builds trust and reduces the chance of customers churning because of unexpected charges or inflexible plans. Handling price increases the right way is especially important. Frame them as investments in improving your service or adding new features – not just a price hike.

Finally, make subscription changes smooth and easy. Let customers upgrade, downgrade, or pause their subscriptions without a hassle. This flexibility keeps everyone happy and subscriptions active. By focusing on these key areas, you can transform billing from a potential pain point to a chance to build stronger customer relationships and boost that all-important long-term loyalty.

Turning Failed Payments Into Retained Customers

Failed payments are a fact of life with recurring billing. The real difference between thriving and struggling businesses? How they handle these inevitable hiccups. I've seen it firsthand: a smart recovery strategy can transform lost revenue into solid customer relationships.

The biggest mistake? Treating all failed payments the same. An expired card needs a different approach than insufficient funds. This is where Stripe's smart retry logic becomes invaluable. It automatically retries payments based on intelligent algorithms, maximizing your recovery chances without annoying customers with constant notifications.

Communicating With Customers: The Right Way

When a payment does fail, clear communication is key. Forget generic "payment failed" emails. Explain why it failed and how to fix it. I worked with a SaaS company in Manchester that reduced their involuntary churn by a whopping 60% just by improving their communication around failed payments. Their secret? Friendly, helpful language and readily available support via phone or live chat.

Real-World Recovery Wins

A London-based subscription box service I know actually turned payment failures into customer service wins. When a payment bounced, they sent a personalized email offering a temporary extension while the customer updated their card. This simple act of empathy built serious goodwill and significantly reduced churn. Speaking of building goodwill and monetizing communities, check out our guide on how to make money on Telegram.

Using Stripe Analytics to Spot Patterns

The Stripe analytics dashboard is a goldmine. It helps you spot patterns in failed payments. Are a lot of cards expiring in a particular month? Perhaps it’s time to proactively remind customers to update their details. By spotting these trends early, you can prevent future failures and keep those subscriptions rolling in. Trust me, this proactive approach can make a huge difference to your bottom line.

Advanced Stripe Features That Scale Your UK Business

007ab4ed-3777-4e42-b69a-31faf3b44b3d.jpg

So, you've nailed the basics of Stripe recurring payments. Awesome! Now, let's talk about supercharging your UK membership service with some seriously powerful features. These are the tools that help businesses truly take off.

Handling Complex Billing Scenarios Like a Pro

One area where growing businesses often stumble is mid-cycle upgrades. Thankfully, Stripe's proration feature handles these like a dream. It automatically calculates the correct amount to bill customers when they switch plans mid-subscription. No more manual number crunching – just smooth, automated billing. Similarly, you can tweak existing subscriptions without throwing your billing cycles into chaos. Stripe keeps everything predictable and organised.

Let me give you a real-world example. Imagine a customer upgrading from your "Basic" plan to your "Premium" plan halfway through their billing cycle. Proration swoops in and automatically calculates the correct prorated amount for the remaining time on "Basic", plus the prorated cost for the upgraded "Premium" plan. Clean, simple, and accurate. This kind of automation not only saves you heaps of time but also prevents billing errors and keeps your customers happy. And happy customers? They're the lifeblood of any successful business.

UK Accounting Integration and VAT Handling

For smooth scaling in the UK, integrating Stripe with your accounting software is essential. Connecting to platforms like Xero or QuickBooks automates your reconciliation, freeing you from tedious manual data entry. Plus, Stripe makes handling VAT for international customers a breeze, automatically calculating and collecting the correct amounts based on their location. No more VAT headaches for you!

Now, let's talk about staying ahead of the curve. The UK payments landscape is constantly shifting, especially with Variable Recurring Payments (VRPs) coming into play (estimated late 2025). These aim to give consumers more control over their recurring payments. Staying informed about these changes and adapting is crucial for long-term success. Check out this article for more insights on the future of UK payments: Future Trends in UK Payments.

To help you strategically plan for the future, I've put together a roadmap outlining when UK businesses should consider implementing these advanced Stripe features.

To help you visualise this, I've created a roadmap:

This roadmap gives you a strategic timeline for implementing Stripe's advanced features. It’s tied to your business growth milestones and subscriber volume, helping you prioritize what's important at each stage. Starting with basic features at launch and gradually incorporating more advanced functionalities as your business grows helps ensure you're not overwhelmed and you maximize your revenue potential.

Your Practical Implementation Roadmap For Success

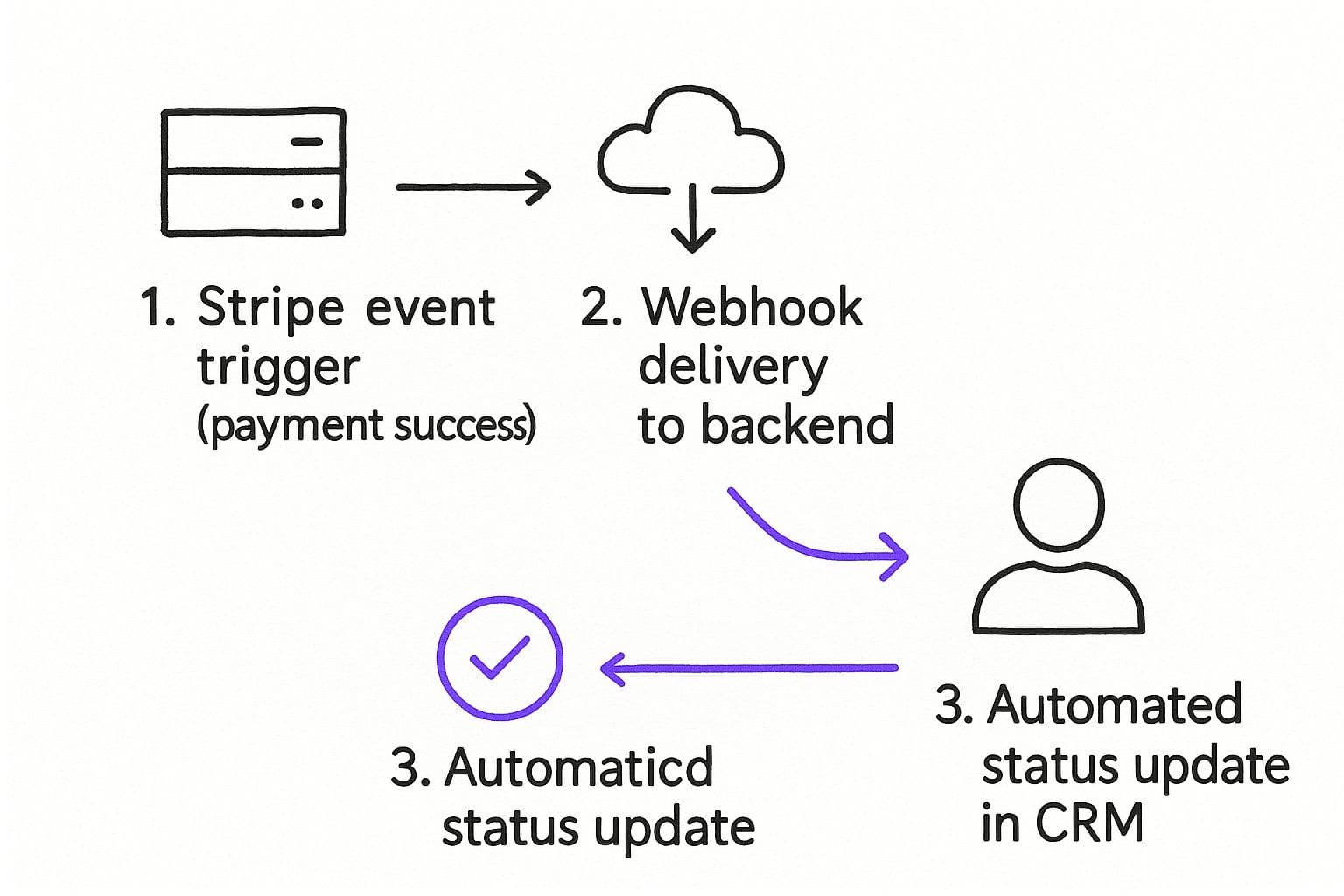

e52953f1-9708-47ca-8148-963e2d2b868a.jpg

This infographic shows what happens after someone makes a successful recurring payment through Stripe. See how that payment confirmation kicks off a webhook, sending info to your backend systems and updating your CRM? This automation is pure gold – it keeps your data synced and avoids manual errors. Trust me, a solid automated system like this is key to scaling recurring revenue without pulling your hair out. If you're keen to explore more about automating your workflows with Stripe, check out these workflow automation examples.

Now, let's talk about how you'll actually get Stripe recurring payments up and running for your UK business. Consider this your personal action plan, a practical guide from someone who's been there. We’ll break it down into phases, with realistic timelines you can actually work with.

Phase 1: Building Your Foundation (1-2 Weeks)

First things first: get your Stripe account set up right. This includes configuring those all-important webhooks. Seriously, don't skip the testing phase. A little testing now saves a lot of headaches later. And since you're in the UK, make sure your VAT settings are dialed in from the get-go. Compliance from day one is always a good idea.

Phase 2: Nailing Your Pricing and Plans (1 Week)

Next up, create a pricing structure that makes sense for your customers and works seamlessly within Stripe. Maybe you'll go with tiered options, or perhaps a simple flat rate will do the trick – it all depends on your business. Spend some time thinking about how you present your pricing too. A little tweaking here can make a big difference in conversions.

Phase 3: Creating a Stellar Customer Experience (Ongoing)

This one's an ongoing journey. Use Stripe's customer portal to empower your subscribers to manage their own billing – less work for you, more control for them. Set up automated emails that actually provide value (nobody likes spam). Remember, it's about building relationships, not just processing transactions.

Phase 4: Optimizing For Growth (Monthly/Quarterly)

Once you're up and running, regularly review your Stripe analytics. Look for patterns in failed payments – maybe there's a tweak you can make to your recovery process. As you grow, explore Stripe's advanced features. And stay on top of changes in UK payment regulations, like those upcoming VRPs.

Following this roadmap will help you build a solid recurring revenue stream and create a smooth experience for your customers. Want a simple but powerful tool to help you manage memberships and even monetize your Telegram community? Check out MyMembers.