It's a common assumption, and a painful one to get wrong: that issuing a refund on Stripe is free. While you do send the full purchase amount back to your customer, Stripe keeps the original transaction fee.

This means every single refund comes with a direct, non-recoverable cost to your UK business.

The Hidden Costs of a Stripe Refund

When you process a sale, Stripe charges a fee for its services—things like facilitating the payment, verifying card details, and moving the money securely. Think of it as a non-refundable booking fee for the work they’ve already done.

Even if the customer's purchase gets reversed, the cost of that initial work remains. This policy isn’t unique to Stripe; it’s standard across most payment processors, but it still catches a lot of creators and small business owners by surprise.

Getting your head around this is vital for managing your finances. For every customer who asks for their money back, you don’t just lose the sale's revenue—you also have to absorb the payment processing cost out of your own pocket. These small amounts, known as Stripe refund charges, can really add up, quietly eating away at your profit margins.

Stripe Cost Breakdown for a £100 Transaction vs Refund

Let's look at a simple comparison. Imagine a £100 sale. For UK businesses using standard European cards, the Stripe fee is typically 1.5% + 20p. Here’s how the numbers play out when a sale goes through versus when it’s refunded.

| Scenario | Customer Payment | Stripe Processing Fee (e.g., 1.5% + 20p) | Net to Merchant | Final Cost to Merchant |

|---|---|---|---|---|

| Successful Sale | £100 | £1.70 | £98.30 | £1.70 |

| Full Refund | -£100 (returned to customer) | £1.70 (kept by Stripe) | £0.00 (from sale) | £1.70 |

The table makes it crystal clear. In a refund scenario, you don't just break even; you end up £1.70 out of pocket. You lose the sale and pay for the privilege.

A Real-World Example

Let's break it down with a different number. Say you sell a digital product for £50 through your membership platform.

- Initial Transaction: Stripe processes the £50 payment.

- Stripe Fee: They deduct their fee of £0.95 (£50 * 1.5% + 20p).

- Your Net Revenue: You pocket £49.05.

A week later, the customer asks for a full refund. You process it, and they get their £50 back. But Stripe doesn't return that £0.95 fee to you. You are now down £0.95, plus you've lost the original sale.

It might seem like a small hit, but if you're running a business with a high volume of transactions, it quickly becomes a very real operational expense.

Key Takeaway: The cost of a refund is never zero. The merchant always absorbs the cost of the original transaction fee, which makes proactive refund management essential for your financial health.

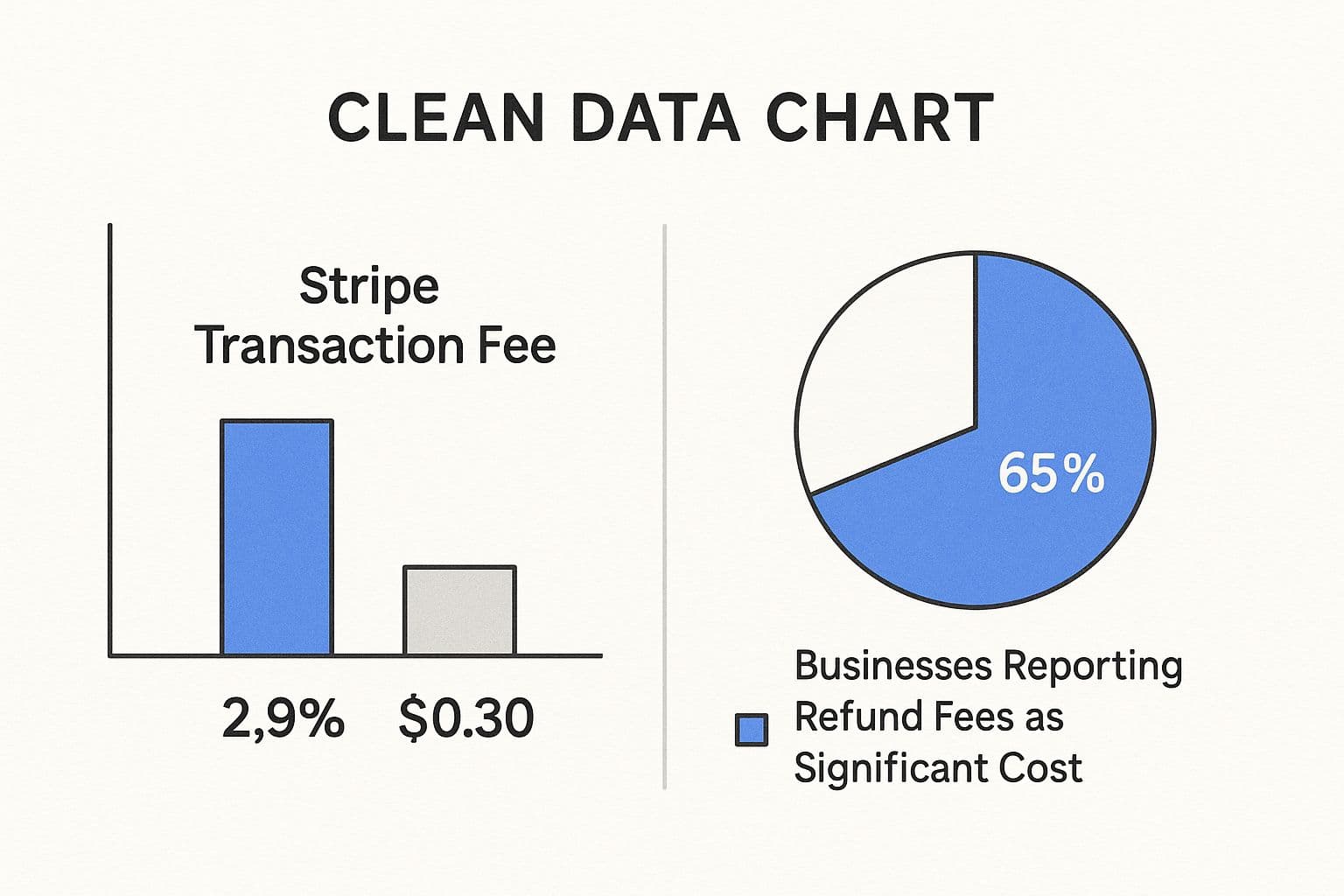

This infographic breaks down Stripe's fee structure and highlights just how much of a growing concern these refund costs are for businesses.

05f84f50-c151-47a4-841c-c080ae51050c.jpg

As you can see, a huge number of businesses report these non-refundable fees as a significant cost. One of the best ways to get ahead of refund requests is by offering overwhelming value upfront, which can be boosted by smart promotional offers.

You can get the full rundown on how to set up discounts in our guide to Stripe promotion codes.

How New Chargeback Fees Can Hurt Your Business

While non-refundable transaction fees are a known cost of doing business, chargeback fees are a totally different beast. They represent a much bigger, more immediate financial sting.

Unlike a standard refund you choose to issue, a chargeback is a forced reversal kicked off by the customer’s bank. For creators and businesses in the UK using Stripe, this process just got a lot more expensive.

When a customer disputes a charge, you’re instantly put on the defensive. Stripe slaps you with a fee the second the dispute is opened—it doesn't matter if it's a legitimate complaint or just a case of "friendly fraud". You're already out of pocket before you've even had a chance to plead your case.

The New Chargeback Fee Structure

Stripe's updated policy for UK merchants isn't just a single charge. It’s a multi-layered system that can hit your finances twice, turning every single chargeback into a major headache.

Here’s the breakdown: Stripe’s UK framework now involves a dual fee structure. It starts with a £20 fee the moment a customer lodges a chargeback. If you decide to challenge it, an additional £20 fee is added to the pile, bringing the potential cost to £40 per incident if you actively fight back. You can dig into the full details of this recent change to see how it’s shaking things up for small businesses and developers.

This forces you into a really tough spot:

- Accept the Dispute: You lose the original sale amount, the non-refundable transaction fee, and the initial £20 dispute fee.

- Fight the Dispute: You risk paying an extra £20 fee on top of everything else if the bank sides with the customer.

Key Insight: The new Stripe chargeback system in the UK means you are financially penalised just for receiving a dispute, before you even get to tell your side of the story.

This system puts merchants in a precarious position, especially creators with smaller transaction values like those using MyMembers. Fighting a £40 chargeback over a £25 subscription just doesn't make any sense financially.

A Real-World Example of How Costs Escalate

Let's make this real. Imagine you run a successful Telegram community using MyMembers, selling access for a one-time fee of £50. A new member disputes the charge with their bank, claiming they didn't authorise it.

Instantly, you're hit with a £20 chargeback fee from Stripe. The original £50 sale is also clawed back from your account and held hostage until the dispute is resolved.

The official Stripe documentation gives a clear overview of the dispute lifecycle, which kicks off the moment a cardholder questions a payment.

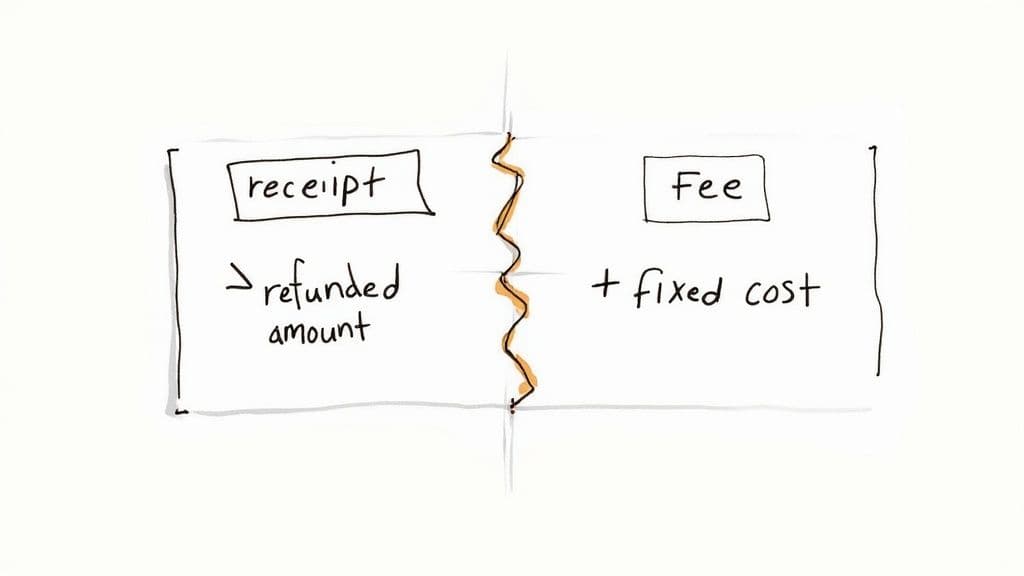

d50bd7c9-8f37-4fd2-8615-98e97e753e9c.jpg

As this process shows, the funds are immediately pulled from your balance and held by the bank, highlighting the instant financial hit.

Now you have a decision to make. If you accept the dispute, you’ve lost the £50 sale plus the £20 fee, for a total loss of £70. If you decide to fight it and lose, that loss skyrockets to £90. These escalating Stripe refund charges and dispute fees can quickly turn one difficult customer into a significant financial setback.

Calculating the True Impact on Your Profit Margins

A single chargeback costs you far more than just the initial dispute fee. To really get your head around the financial damage, you need to look past Stripe’s statement and tally up the total loss from every angle. It’s not just the money they claw back; it’s the product you’ve lost, the time you’ve wasted, and the sneaky fees that pile up and gut your profits.

07a7484d-9c0a-4755-9a01-6ece66b5e141.jpg

Let's walk through the journey of one disputed sale to see just how quickly a small problem can blow a massive hole in your finances, especially for a UK-based creator. This breakdown will put the real-world cost into pounds and pence.

The Anatomy of a £100 Disputed Sale

Imagine you’ve just sold a premium digital course for £100. A customer snaps it up, but a month later, they hit you with a chargeback, claiming the transaction was fraudulent.

Here’s the financial car crash that follows:

- Lost Revenue (£100): The full £100 is immediately yanked from your Stripe balance and sent back to the customer's bank. The money from your sale is just… gone.

- Original Transaction Fee (£1.70): Stripe doesn’t refund their cut. You still have to pay the original processing fee (for example, 1.5% + 20p for UK cards). That cost is now entirely on you.

- Chargeback Fee (£20): On top of everything else, you’re instantly hit with a non-refundable £20 fee simply because the dispute was opened.

- Lost Product (Priceless): The customer, in all likelihood, still has access to your digital course. Your intellectual property has effectively been stolen.

So, before you’ve even decided whether to fight it, your total immediate loss is £121.70 on a sale that was meant to make you £100.

Key Takeaway: A chargeback doesn’t just reverse a sale; it multiplies your losses. You lose the revenue, the product, and get slapped with extra fees for your trouble.

And that’s just the start. The situation gets even worse if you decide to contest it.

The Escalating Costs of Fighting Back

You know the chargeback is bogus, so you decide to fight it. You spend your precious time gathering evidence—screenshots, login records, and email chains—to prove your case to Stripe. But if the bank ultimately sides with the customer anyway, the financial hit gets deeper.

- Dispute Counter-Fee (£20): Because you fought the dispute and lost, Stripe hits you with another £20 fee.

Let's do the final maths on this single, disputed £100 transaction:

- Lost Revenue: £100.00

- Original Stripe Fee: £1.70

- Initial Chargeback Fee: £20.00

- Lost Dispute Fee: £20.00

- Total Financial Loss: £141.70

This turns a profitable sale into a painful liability. Standard Stripe fees are a known cost of doing business, but when refunds and chargebacks enter the picture, the expenses compound fast. With chargeback rates in e-commerce hovering around 0.5% to 1%, a creator with steady sales could easily lose thousands of pounds a year to these fees alone. If you want to dig into the fine print, you can learn more about Stripe’s pricing and fee structure on their site.

Even a "low" chargeback rate can silently bleed your business dry. By understanding these true costs, you can start forecasting your expenses properly and build a financial buffer to protect yourself.

So, Can Stripe’s Smart Disputes AI Actually Help You?

Fighting a chargeback feels like a lose-lose. You can either swallow the loss or risk getting hit with even bigger fees if you try to fight it and fail. To fix this, Stripe rolled out an AI tool designed to tip the scales back in your favour.

dd743279-636e-4c69-b53e-82e1502a0b4c.jpg

But it comes with its own trade-offs.

The tool is called Smart Disputes. Its whole promise is to automate the painful process of gathering evidence and submitting it for you. Stripe introduced this AI for UK merchants to soften the blow of its new fee structure. If you opt into Smart Disputes, Stripe agrees to waive the £20 dispute counter-fee when you contest a chargeback. You can get the full rundown on how this fits into Stripe's updated fee policies in the UK.

Here’s the catch, though. This automated help isn't free. This is where you need to pay close attention.

Think of It as a “No-Win, No-Fee” Lawyer

Imagine hiring a lawyer who only gets paid if they win your case. They handle all the messy paperwork and arguments for you without any upfront cost.

But if they win and get your money back? They take a big slice of the pie.

Stripe’s Smart Disputes works on the exact same principle. If the AI successfully wins your dispute, Stripe charges a 30% success fee on whatever amount it recovers. This is on top of the initial, non-refundable chargeback fee you already paid.

Key Insight: Smart Disputes gets rid of the risky £20 counter-fee but adds a new cost: a 30% commission on any money it wins back for you.

This completely changes the maths. Instead of a fixed fee, your cost is now totally variable, depending on the outcome and the size of the original transaction.

So, Is Smart Disputes Actually Worth It?

Deciding whether to use this tool really comes down to your average sale price and how much risk you’re comfortable with. Let’s look at a couple of scenarios for a creator using a platform like MyMembers.

- Low-Value Sales: Say you sell a monthly membership for £15. If a customer disputes that charge and Smart Disputes wins it back, Stripe takes a 30% cut (£4.50). You get back £10.50. This is probably better than losing the full amount and paying extra fees to fight it.

- High-Value Sales: Now, let's say you sell a one-time course for £200. If Smart Disputes wins the case, Stripe takes a whopping £60 commission (30% of £200). You only get back £140. At this point, the fee is so substantial you might wonder if you’d have been better off handling the dispute yourself, despite the risk.

Ultimately, Smart Disputes is a strategic shield. It protects you from the guaranteed cost of fighting a losing battle, but it takes a hefty commission for its victories.

For creators with lots of small transactions, it could be a lifesaver against mounting Stripe refund charges. But for those selling high-ticket items, that 30% fee could eat a serious hole in your revenue.

Actionable Strategies to Reduce Refunds and Disputes

embed

Dealing with Stripe refund charges after the fact is a total drain on your time and profits. The best defence? A strong offence. By getting ahead of potential issues, you can kill the chance of a customer asking for their money back or, even worse, filing a chargeback.

This isn't about some complicated technical fix. It's about building trust and setting brutally honest expectations from the very first click. Let's break down the practical steps you can take to protect your revenue by tackling the root causes of customer dissatisfaction before they even start.

Set Crystal-Clear Expectations

The number one reason for refunds is a mismatch between what a customer thought they were getting and what they actually received. Your service could be incredible, but if you described it poorly, you're just setting yourself up for failure.

Think of your product description as a contract with your customer. Be painfully honest and ridiculously detailed about what they’re buying, especially for digital products or membership access where things can feel a bit intangible.

- Be Specific About Deliverables: Selling access to a Telegram group? Spell out exactly what’s included. Do they get direct access to you? Weekly Q&As? A library of resources? Don’t let their imagination fill in the blanks, because it rarely matches reality.

- Use High-Quality Visuals: For digital courses or downloads, use screenshots, video previews, or a detailed table of contents. Show, don't just tell. Eliminate any shred of ambiguity about what’s behind the paywall.

- Make Your Policies Obvious: Don't bury your refund or cancellation policy in the footer of some forgotten page. Stick a clear, easy-to-find link right next to the purchase button. A fair policy builds trust, even if a customer never needs to use it.

Provide Proactive and Accessible Support

Excellent customer service is your most powerful weapon against disputes. When a customer runs into a problem, their first thought should be to contact you, not their bank. You have to make it absurdly easy for them to do that.

A customer who feels heard is far less likely to escalate a minor hiccup into a costly chargeback. To get this right, it's worth exploring effective strategies for preventing chargebacks that are all about smart communication.

Key Takeaway: A visible "Contact Us" button or a support email is infinitely cheaper than any dispute fee. A quick, helpful response can turn a potential refund into a loyal fan.

On top of that, creating a simple FAQ page that answers common questions about your service, billing, or access can prevent a massive number of support tickets and disputes from ever happening. For creators, this simple step is a non-negotiable part of long-term success. You can dive deeper into this by reading our guide on customer retention best practices.

Use Stripe's Built-In Tools

Finally, don't forget that Stripe itself gives you tools to spot risky transactions before they blow up in your face. Stripe Radar is a machine-learning fraud detection system that’s already included with your account. You might as well use it.

Radar looks at every single payment and gives it a risk score. You can set up rules to automatically block high-risk payments or just flag them for you to review manually. This is your first line of defence against fraudulent chargebacks, which are almost impossible to win.

Taking a few minutes to check and configure your Radar rules can save you from some serious financial headaches down the road.

Frequently Asked Questions About Stripe Fees

Navigating the world of payment processing can feel like learning a new language. You're hit with confusing terms and hidden costs from every angle. For UK creators and merchants, getting your head around Stripe refund charges and dispute fees is mission-critical for protecting your hard-earned revenue.

We get it. To cut through the noise, we've put together direct answers to the most common questions we hear from business owners just like you.

Does Stripe Charge an Extra Fee for Refunds?

This is where most people get tripped up. The short answer is no, Stripe doesn’t charge an additional fee to process a refund. But here’s the catch: they don't return the original processing fee from the initial transaction.

Think of it like this: the work to process your customer's payment was already done. So, when you issue a refund, you lose the sale and you still have to cover the cost of that original payment. For UK cards, that's typically a percentage plus a fixed amount (like 1.5% + 20p), which you now have to absorb completely.

The Bottom Line: A refund on Stripe is never free. The "fee" you pay is the non-refundable cost of the original transaction, and it eats directly into your profit margin every single time.

How Are Subscription Refunds Handled?

Refunds for recurring payments—the lifeblood of any membership business—follow the exact same logic. When you refund a customer for a monthly or annual subscription payment, Stripe keeps the processing fee tied to that specific charge.

For example, if you refund a £20 monthly membership fee, you're still out the original transaction cost for that £20 payment. It’s a small detail that can really add up, which is why having crystal-clear refund terms for your members is so important. For a deeper dive into managing these payments, our guide on Stripe recurring payments is a must-read.

What Is the Difference Between a Refund and a Chargeback?

Understanding this difference is crucial. One costs you a little; the other is a financial gut punch.

- A Refund is something you initiate. Your customer gets in touch, and you voluntarily agree to send their money back. The only hit you take is the non-refundable original processing fee. It's a clean break.

- A Chargeback is a forced reversal kicked off by the customer's bank. This is what happens when a customer disputes a charge directly with their card issuer, completely bypassing you.

Chargebacks are infinitely more damaging. In the UK, Stripe slaps you with a non-refundable £20 dispute fee the second a chargeback is filed—before you even get a chance to fight it. You lose the original sale, the transaction fee, and get stung with this extra penalty.

Where Can I Find More General Information?

Payment processing isn't a "set it and forget it" part of your business. Policies change, fees get updated, and staying informed is the only way to protect your bottom line. To keep learning and dig deeper into the platform, you can explore general information about Stripe from trusted third-party guides. Keeping yourself up-to-date means you'll never be caught off guard by a policy change again.

Ready to turn your Telegram community into a thriving, automated business without the administrative headaches? MyMembers integrates directly with Stripe to manage your subscriptions, payments, and member access seamlessly. Join over 1,000 creators and start building your membership business today. Get started with MyMembers.